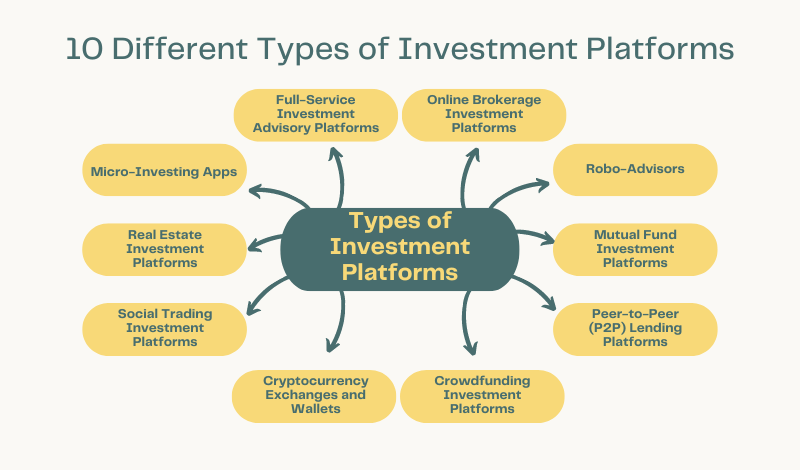

Investment Platforms: Explore Your Options for Financial Growth

In today’s dynamic financial landscape, investing has become an essential aspect of securing your financial future. With a myriad of Financial Platforms available, it can be overwhelming to navigate the various options. Whether you’re a seasoned investor or just starting your investment journey, understanding the different types of investment platforms is crucial to make informed decisions and achieve your financial goals. In this comprehensive article, we’ll delve into the diverse range of Financial Platforms, their features, and their suitability for different investment strategies.

1. Online Brokerage Investment Platforms:

Online brokerage platforms have revolutionized the investment industry, offering investors convenient access to a wide range of financial instruments. These platforms allow you to buy and sell stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other securities through an online interface. Some popular online brokerage platforms include Fidelity, TD Ameritrade, E*TRADE, and Charles Schwab.

Key features of online brokerage platforms:

– User-friendly interface for trading and portfolio management

– Access to research tools, market data, and analyst reports

– Ability to trade a variety of asset classes, including stocks, bonds, ETFs, and more

– Mobile trading capabilities through dedicated apps

– Educational resources for investors of all levels

2. Robo-Advisors:

Robo-advisors are digital investment platforms that utilize algorithms and computer models to provide automated, personalized investment advice and portfolio management services. These platforms typically employ modern portfolio theory and diversification strategies to construct and manage investment portfolios based on an investor’s risk tolerance, investment goals, and time horizon. Popular robo-advisor platforms include Betterment, Wealthfront, and Acorns.

Key features of robo-advisors:

– Automated portfolio construction and rebalancing

– Low fees compared to traditional financial advisors

– Diversified portfolios composed of low-cost ETFs

– Goal-based investing strategies

– Tax-efficient portfolio management

– User-friendly interfaces and mobile apps

3. Mutual Fund Investment Platforms:

Mutual fund platforms offer investors access to a wide range of mutual funds from various asset management companies. These platforms provide a centralized platform for researching, comparing, and investing in mutual funds. Some popular mutual fund platforms include Vanguard, Fidelity, and Charles Schwab.

Key features of mutual fund platforms:

– Access to thousands of mutual funds from various fund families

– Ability to research and compare fund performance, fees, and investment strategies

– Automated portfolio rebalancing and reinvestment of dividends

– Educational resources and tools for mutual fund investing

– Retirement planning and investing options

4. Peer-to-Peer (P2P) Lending Platforms:

Peer-to-peer (P2P) lending platforms connect borrowers with individual investors who are willing to lend money. These platforms facilitate the lending process and allow investors to diversify their investment portfolios by lending to a pool of borrowers. Popular P2P lending platforms include LendingClub, Prosper, and Funding Circle.

Key features of P2P lending platforms:

– Potential for higher returns compared to traditional fixed-income investments

– Diversification by investing in multiple loans

– Automated loan selection and portfolio management tools

– Access to borrower credit information and risk assessment

– Flexibility in choosing loan types and investment amounts

5. Crowdfunding Investment Platforms:

Crowdfunding platforms have emerged as a popular way for individuals to invest in various projects, startups, and small businesses. These platforms connect entrepreneurs and businesses with potential investors, allowing them to raise funds through equity, debt, or reward-based campaigns. Popular crowdfunding platforms include Kickstarter, Indiegogo, and Fundrise.

Key features of crowdfunding platforms:

– Access to investment opportunities in startups, real estate, and other alternative investments

– Diversification across multiple projects or properties

– Potential for high returns, but with higher risk

– Transparency and project updates from entrepreneurs or developers

– Ability to support innovative ideas and projects

6. Cryptocurrency Exchanges and Wallets:

As digital currencies like Bitcoin and Ethereum gain mainstream attention, cryptocurrency exchanges and wallets have become popular investment platforms for those interested in investing in cryptocurrencies. These platforms facilitate the buying, selling, and storing of various cryptocurrencies. Some well-known cryptocurrency exchanges and wallets include Coinbase, Binance, and Kraken.

Key features of cryptocurrency exchanges and wallets:

– Access to a wide range of cryptocurrencies for trading and investing

– Secure storage of digital assets through hot and cold wallets

– Advanced trading tools and charts for technical analysis

– Integration with fiat currencies for easy buying and selling

– Educational resources for understanding cryptocurrency markets

7. Social Trading Investment Platforms:

Social trading platforms combine the power of social networking with investment opportunities. These platforms allow users to follow and copy the trades of successful investors, share investment strategies, and collaborate with other traders. Popular social trading platforms include eToro, ZuluTrade, and AvaTrade.

Key features of social trading platforms:

– Ability to follow and copy the trades of successful investors

– Social networking features for sharing investment ideas and strategies

– Transparent performance tracking and risk management tools

– Educational resources and virtual trading environments

– Integration with traditional asset classes and cryptocurrencies

8. Real Estate Investment Platforms:

Real estate investing platforms have emerged as a way for investors to gain exposure to the real estate market without the need for direct property ownership. These platforms offer opportunities to invest in various real estate projects, including residential and commercial properties, as well as real estate investment trusts (REITs). Popular real estate investing platforms include Fundrise, RealtyMogul, and PeerStreet.

Key features of real estate investing platforms:

– Access to a diverse range of real estate investment opportunities

– Fractional ownership and diversification across multiple properties

– Potential for passive income through rental properties or dividends

– Streamlined investment process and property management services

– Transparency and detailed property information

9. Micro-Investing Apps:

Micro-investing apps have gained popularity by making investing accessible to a broader audience, even with small amounts of capital. These apps allow users to invest spare change or small amounts of money regularly, often through automatic transfers or round-up features. Popular micro-investing apps include Acorns, Stash, and Raiz.

Key features of micro-investing apps:

– Automated investing with small amounts of money (e.g., spare change)

– Diversified portfolios composed of ETFs and stocks

– Goal-based investing strategies

– Educational resources for beginners

– Mobile-friendly platforms and user-friendly interfaces

10. Full-Service Investment Advisory Platforms:

While many investment platforms offer self-directed investing options, some investors prefer to work with professional financial advisors. Full-service investment advisory platforms provide access to personalized financial planning, portfolio management, and investment advice from licensed professionals. Well-known full-service investment advisory platforms include Merrill Lynch, Morgan Stanley, and UBS.

Key features of full-service investment advisory platforms:

– Personalized financial planning and investment advice

– Access to a wide range of investment products and services

– Portfolio management and monitoring by experienced professionals

– Comprehensive retirement planning and estate planning services

– Access to exclusive investment opportunities and research

Whether you’re a seasoned investor or just starting your investment journey, understanding the different types of investment platforms is essential to make informed decisions and achieve your financial goals. From online brokerage platforms to robo-advisors, mutual fund platforms to crowdfunding platforms, and cryptocurrency exchanges to real estate investing platforms, the investment landscape offers a multitude of options to suit your investment preferences, risk tolerance, and financial objectives.

Remember, investing involves risks, and it’s crucial to conduct thorough research, understand your investment goals, and seek professional advice if needed. By exploring the various investment platforms available, you can diversify your portfolio, access new investment opportunities, and navigate the financial markets with confidence.