18 Proven Tips to Drastically Reduce Your Monthly Expenses

Are your monthly expenses weighing you down and making it tough to get ahead financially? Reducing recurring costs can free up cash flow, help you pay off debt faster, and allow you to save and invest more money for your future goals. While you can’t eliminate every expense, there are many creative ways to cut costs significantly. Here are 18 proven tips to reduce your monthly expenses dramatically:

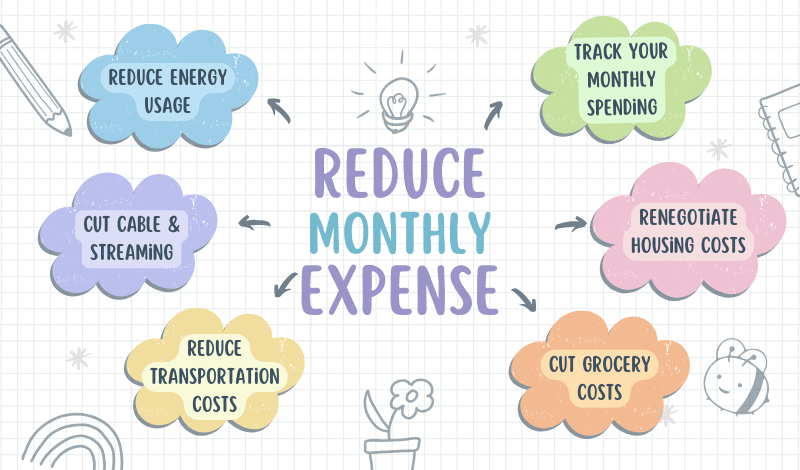

1. Track Your Monthly Spending:

The first step is getting visibility into how much you’re spending each month and on what. Record every expense using an app like Mint or You Need a Budget. Categorize all your costs like housing, transportation, food, utilities, subscriptions, etc. Identify non-essential spending categories to cut or reduce. This will allow you to see exactly where you can implement the 18 Ways to Reduce Monthly Expenses.

2. Renegotiate Housing Costs:

Housing expenses like rent/mortgage and renter’s insurance are often the biggest recurring monthly cost. Explore options to lower housing costs, like downsizing to a cheaper rental, getting a roommate, or negotiating your rent. If you own, consider refinancing your mortgage at a lower rate or moving to an area with lower costs. Implementing these strategies are among the 18 Ways to Reduce Monthly Expenses that can have the biggest impact.

3. Downgrade to Lower Car Costs:

Transportation costs for car payments, insurance, gas, and maintenance can take a huge bite out of income. By driving a used car you own outright versus leasing or financing, you can save hundreds per month. When it’s time to replace your vehicle, choose an affordable and efficient pre-owned model. Reducing transportation expenses is one of the 18 Ways to Reduce Monthly Expenses that can lead to major savings.

4. Move Fixed Costs to Lower Priorities:

Take a look at all fixed monthly expenses like car insurance, cable/internet, gym memberships, app subscriptions, etc. Move as many non-essentials as possible to lower priority status. At the very least, renegotiate for lower rates or temporarily freeze memberships to reduce costs. Cutting back on these recurring bills is one of the 18 Ways to Reduce Monthly Expenses that can provide quick savings.

5. Cut Grocery Costs:

Reduce food costs by planning budget-friendly meals around what’s on sale and in season. Make a grocery list and stick to it, buy generic brands, meal prep for the week, and pack your own snacks and lunches. Ordering food for delivery can easily cost $50+ per meal, so avoid food delivery unless splitting costs. Cutting back on food spending is one of the 18 Ways to Reduce Monthly Expenses that allows you to reallocate that money towards other goals.

6. Slash Energy & Utility Bills:

Make your home more energy-efficient by adjusting thermostat temperatures, installing LED bulbs and low-flow shower heads, sealing air leaks, unplugging unused electronics, and looking for lower rates from providers. Go minimal on cable/streaming packages or temporarily suspend service. Reducing utilities and entertainment costs are part of the 18 Ways to Reduce Monthly Expenses that can lead to meaningful savings.

7. Reduce Transportation Costs:

Besides downsizing your vehicle, cut transportation expenses by carpooling, taking public transit, and walking/biking when possible. You could save hundreds by getting rid of your car completely if you live in a walkable area. Reducing transportation costs is one of the 18 Ways to Reduce Monthly Expenses that can free up a significant amount of money each month.

8. Pay off High-Interest Debt:

While not a monthly expense itself, interest charges make every purchase with debt more expensive. Create a plan to aggressively pay off credit cards and loans with high interest rates. Eliminating interest frees up cash flow each month. Paying off debt is one of the 18 Ways to Reduce Monthly Expenses indirectly, as it allows you to reallocate money previously going towards interest.

9. Quit Unhealthy Spending Habits:

Do you spend money each day on things like dining out for lunch, daily coffee runs, smoking, etc.? These daily habits can easily add up to $100 or more per month. Quitting them or finding cheaper alternatives is an easy way to cut expenses and implement one of the 18 Ways to Reduce Monthly Expenses. Eliminating small daily splurges can lead to significant savings over time.

10. Cut Cable & Streaming:

Traditional cable packages can cost well over $100/month or more. Consider switching to lower-cost streaming services, finding free content online, or temporarily suspending service. Be sure to ask about discounts or promotions. Cutting cable and finding cheaper entertainment options is one of the 18 Ways to Reduce Monthly Expenses that allows you to reallocate that spending elsewhere.

11. Cancel Unnecessary Subscriptions:

Speaking of subscriptions, take an inventory of what you’re paying for monthly like apps, online services, subscription boxes, etc. Cancel anything you no longer use or find free alternatives for. Even small amounts add up quickly. Auditing and reducing subscription costs is one of the 18 Ways to Reduce Monthly Expenses that can trim your recurring bills.

12. Downgrade Phone Plans:

Cell phone bills can easily exceed $100/month per line. Downgrade to lower data packages and consider switching to low-cost carriers like Republic Wireless, Mint Mobile, or an MVNO to save $30+ per month. Reducing your cell phone costs is one of the 18 Ways to Reduce Monthly Expenses that allows you to keep essential services while paying less.

13. Get Discounted Internet:

Internet access is increasingly seen as a utility. If your income qualifies, look into getting discounted internet through government assistance programs, nonprofit organizations, or directly from providers. Taking advantage of discounted internet is one of the 18 Ways to Reduce Monthly Expenses that can help lower your bills.

14. Refinance Student Loans:

If you have student loans with high interest rates, look into options to refinance to lower rates. This can reduce your monthly payment and long-term costs on the debt. You may also qualify for loan forgiveness in some cases. Refinancing student loans to get lower rates is one of the 18 Ways to Reduce Monthly Expenses related to debt repayment.

15. Reduce Energy Usage:

In addition to making your home more energy efficient, minimizing usage can lead to lower utility bills each month. Take simple steps like shortening shower times, running larger loads of laundry, unplugging idle devices, and adjusting the thermostat while away. Reducing energy usage through small behavioral changes is one of the 18 Ways to Reduce Monthly Expenses that can lead to meaningful savings on utilities over time.

16. Shop Insurance Annually:

One of the most overlooked ways to reduce monthly expenses is shopping around for better insurance rates on auto, home/renters, health, and life insurance. Comparing quotes annually can lead to significant savings. Shopping your insurance rates is one of the 18 Ways to Reduce Monthly Expenses that people often neglect, but it can pay off substantially.

17. Buy Used & Repair Items:

Rather than continually buying new, get in the habit of buying used items when possible and repairing items you already own rather than always replacing them. This extends the life and reduces the monthly cost of things like furniture, electronics, vehicles, and more. Buying used and repairing instead of replacing is one of the 18 Ways to Reduce Monthly Expenses by cutting down on recurring costs for goods and possessions.

18. Negotiate With Providers:

Whether for your cell phone, cable, internet, insurance, and other services, it never hurts to call up providers and politely ask for discounts or promotions. Simply being a long-time customer is sometimes enough to get fees waived or costs lowered. Negotiating with service providers is one of the 18 Ways to Reduce Monthly Expenses that can lead to lower recurring bills if you’re willing to make the ask.

Reducing your monthly expenses doesn’t have to mean major life changes or sacrifice. Even implementing a handful of these tips can add up to hundreds of dollars in savings each month. Try tracking costs for a few months and be proactive about lowering expenses any way you can. The dollars you save can go towards paying off debt, building an emergency fund, or investing for the future!

Conclusion: 18 Ways to Reduce Monthly Expenses

While cutting expenses may require some sacrifice upfront, the long-term benefits of freeing up cash flow are immense. Having lower monthly obligations lets you save and invest more for your future. It allows you to build up emergency funds to avoid going into debt when unexpected expenses hit. And lowering recurring costs can be the key to truly getting ahead financially.

Start by tracking all your expenses to the dollar and focusing on cutting major recurring costs like housing, transportation, subscriptions, and utilities. Then identify areas to reduce your spending on non-essentials or cut out unhealthy financial habits. Start small by lowering 2-3 expenses and keep working your way down the list.

The dollars you save each month by reducing expenses can be applied towards important wealth-building goals like:

- Paying off debt

- Saving towards large upcoming expenses

- Building an emergency fund

- Contributing to retirement accounts

- Investing for the future

Don’t underestimate the enormous long-term financial gains that will come from making a concerted effort to reduce monthly expenses! What tactics have helped you lower your cost of living?