Demystifying Difference Between Two Financial Powerhouses : 3 Difference Between a Debit and Credit Card

In the world of personal finance, debit cards and credit cards have become ubiquitous tools for everyday transactions. While both serve as convenient payment methods, they operate on fundamentally different principles and have distinct implications for your financial well-being. Understanding the 3 difference between a debit and credit card is crucial for making informed decisions and effectively managing your finances. In this comprehensive article, we’ll explore the contrasting nature of these financial instruments and shed light on their respective advantages and considerations.

What is a Debit Card?

A debit card is a payment card linked directly to your checking or savings account at a bank or credit union. When you make a purchase or withdraw cash using a debit card, the funds are immediately deducted from your account balance. Essentially, a debit card allows you to access and spend your own money conveniently, which is one of the 3 difference between a debit and credit card.

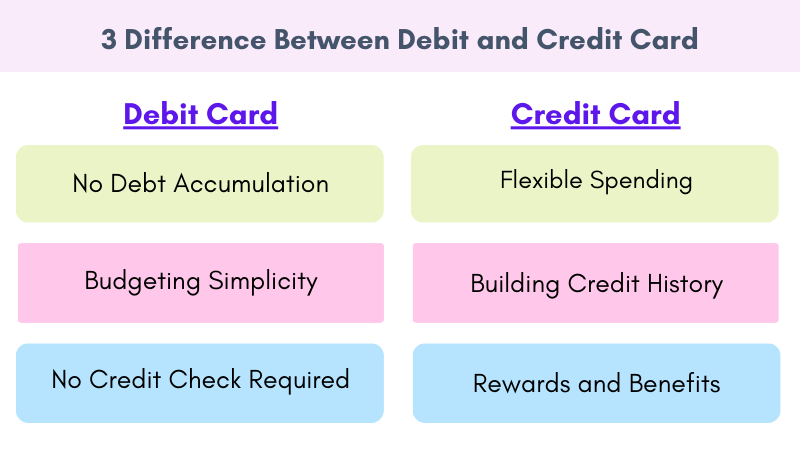

Advantages of Debit Cards

1. No Debt Accumulation: Unlike credit cards, debit cards do not allow you to borrow money or accrue debt. This can help you avoid the temptation of overspending and the potential for interest charges or late payment fees.

2. Budgeting Simplicity: Since debit card transactions are deducted directly from your account, it’s easier to track your spending and maintain a budget. This transparency can promote financial discipline and responsible money management.

3. No Credit Check Required: Debit cards are accessible to anyone with a checking or savings account, regardless of credit history. This makes them a convenient option for individuals with limited or poor credit.

Considerations for Debit Card Use

1. Overdraft Fees: If you attempt to make a purchase or withdrawal that exceeds your available account balance, you may be subject to overdraft fees charged by your bank or credit union. These fees can quickly add up, so it’s essential to monitor your account balance closely.

2. Limited Fraud Protection: While debit cards offer some fraud protection, the level of protection may be lower compared to credit cards. In the event of unauthorized transactions, recovering your funds can be more challenging with a debit card.

3. No Credit-Building Opportunities: Since debit card transactions do not involve borrowing money, using a debit card alone will not help you establish or build your credit history, which is crucial for future lending opportunities.

What is a Credit Card?

A credit card is a revolving line of credit issued by a financial institution or lender. When you make a purchase with a credit card, you are essentially borrowing money from the card issuer, which you must repay at a later date. Credit cards allow you to access funds up to a predetermined credit limit, and you are charged interest on any outstanding balances that are not paid in full each month. This ability to borrow and pay back over time is another key 3 difference between a debit and credit card.

Advantages of Credit Cards

1. Flexible Spending: Credit cards provide access to funds beyond your immediate account balance, allowing you to make larger purchases or handle unexpected expenses more easily.

2. Building Credit History: Responsible credit card usage, including making on-time payments and keeping balances low, can help you establish and improve your credit score, which is essential for securing loans, mortgages, and other financial products in the future.

3. Rewards and Benefits: Many credit cards offer rewards programs, such as cash back, travel points, or other perks, which can provide additional value when used strategically.

Considerations for Credit Card Use

1. Interest Charges and Fees: If you carry a balance on your credit card, you will be charged interest, which can quickly accumulate and become a financial burden. Additionally, credit cards may come with annual fees or other charges that should be carefully evaluated.

2. Potential for Overspending: The availability of credit can lead to the temptation of overspending and accumulating debt beyond your means to repay. Responsible credit card usage and self-discipline are essential to avoid financial difficulties.

3. Credit Score Impact: Late or missed payments, high credit utilization ratios, and other irresponsible credit card behaviors can negatively impact your credit score, making it more difficult to obtain favorable lending terms in the future.

Making the Right Choice: 3 Difference Between a Debit and Credit Card?

The decision to use a debit or credit card ultimately depends on your personal financial situation, goals, and spending habits. Here are some general guidelines to consider when evaluating the 3 difference between a debit and credit card:

1. Budgeting and Debt Avoidance: If you struggle with overspending or prefer to avoid debt altogether, a debit card may be the safer option, as it prevents you from spending more than you have available.

2. Building Credit History: If you are looking to establish or improve your credit score, responsible credit card usage can be beneficial. However, it’s crucial to maintain a good payment history and keep your credit utilization low.

3. Large Purchases or Emergencies: For significant expenses or unexpected financial situations, a credit card can provide greater flexibility and access to funds, as long as you have a plan to pay off the balance promptly.

4. Rewards and Benefits: If you are a disciplined spender who pays off balances in full each month, a rewards credit card can offer valuable perks and incentives, effectively providing a return on your spending.

Ultimately, the choice between a debit or credit card should be guided by your financial goals, discipline, and ability to manage your spending responsibly when considering the 3 difference between a debit and credit card. Many individuals find value in utilizing both debit and credit cards strategically, leveraging the advantages of each while mitigating the potential drawbacks.

Conclusion

Understanding the 3 differences between a debit and credit card is essential for making informed financial decisions. Debit cards offer a straightforward approach to spending your own funds, promoting budgeting simplicity and debt avoidance, while credit cards provide flexibility, credit-building opportunities, and potential rewards. However, credit cards also carry the risk of overspending and accumulating debt if not used responsibly when considering the 4 difference between a debit and credit card.

By carefully evaluating your financial situation, goals, and spending habits, you can determine the right balance between debit and credit card usage, ensuring that these powerful financial tools work in your favor and contribute to your overall financial well-being when considering the 3 difference between a debit and credit card.