Exploring the Diverse World of Real Estate Investments

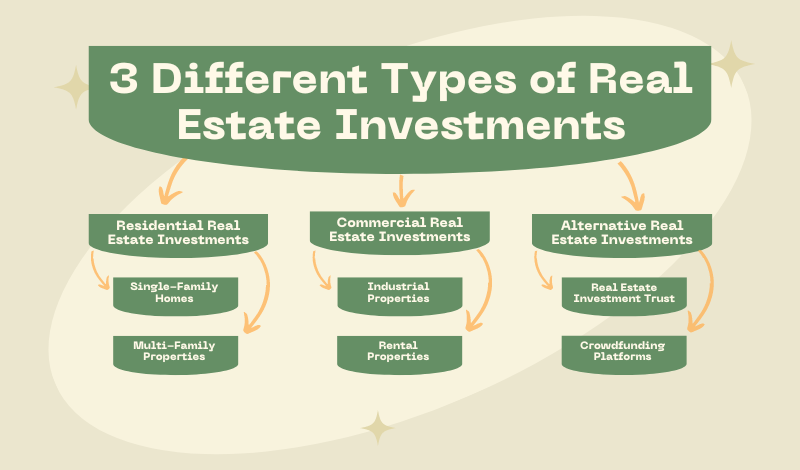

Real estate has long been considered a lucrative and tangible investment option, offering a wide range of opportunities for investors seeking to build wealth and generate passive income. However, navigating the 3 Different Types of Real Estate Investments can be a daunting task, especially for those new to the industry. In this comprehensive article, we’ll delve into the various categories of real estate investments, highlighting their unique characteristics, risks, and potential rewards.

1. Residential Real Estate Investments

1. Single-Family Homes

One of the most common and accessible forms of real estate investment is the purchase of single-family homes, which falls under the category of 3 Different Types of Real Estate Investments. This approach can involve buying properties for rental purposes, with the aim of generating steady cash flow from rental income, or flipping houses, which involves purchasing undervalued properties, renovating them, and reselling them for a profit.

2. Multi-Family Properties

Multi-family properties, such as apartment buildings or duplexes, offer investors the opportunity to generate multiple streams of rental income from a single investment. 3 Different Types of Real Estate Investments: These properties often require more capital upfront but can provide economies of scale in terms of management and maintenance costs.

3. Vacation Rentals

The rise of platforms like Airbnb and VRBO has created a new avenue for real estate investors through vacation rentals. 3 Different Types of Real Estate Investments: This strategy involves purchasing properties in popular tourist destinations and renting them out on a short-term basis, capitalizing on the demand for unique accommodations.

2. Commercial Real Estate Investments

1. Office Buildings

Investing in office buildings can be a lucrative option for investors seeking long-term rental income and potential appreciation. These properties are typically leased to businesses and organizations, providing a steady stream of rental income. However, commercial real estate investments often require substantial capital and may involve longer lease terms and more complex management responsibilities.

2. Retail Properties

Retail properties, such as shopping malls, strip centers, or standalone stores, offer investors the opportunity to generate rental income from businesses catering to consumer demand. These investments can be particularly attractive in areas with strong population growth and consumer spending.

3. Industrial Properties

Industrial properties, including warehouses, distribution centers, and manufacturing facilities, are essential for supporting various industries and supply chains. Investing in industrial real estate can provide stable long-term cash flow and potential appreciation, particularly in areas with strong logistics and transportation networks.

3. Alternative Real Estate Investments

1. Real Estate Investment Trusts (REITs)

REITs are companies that own and operate income-producing real estate assets, such as apartment complexes, office buildings, or shopping malls. By investing in REITs, individuals can gain exposure to real estate without directly owning properties. REITs offer diversification, liquidity, and professional management, making them an attractive option for those seeking passive real estate investment.

2. Crowdfunding Platforms

Crowdfunding platforms have emerged as a innovative way for investors to participate in real estate projects without the need for substantial capital. These platforms pool funds from multiple investors, allowing them to invest in various real estate opportunities, such as commercial developments, multi-family housing complexes, or real estate debt.

3. Real Estate Notes and Mortgage-Backed Securities

Investing in real estate notes and mortgage-backed securities involves purchasing debt instruments secured by real estate assets. This approach can provide investors with a steady stream of interest payments and the potential for capital appreciation.

Factors to Consider When Choosing Real Estate Investments

While the diverse range of real estate investment options offers numerous opportunities, it’s crucial to carefully consider several key factors before making any investment decisions:

1. Investment Goals

Clearly define your investment goals, whether it’s generating passive income, long-term appreciation, or a combination of both. Different real estate investments cater to different objectives, so aligning your investment strategy with your goals is essential.

2. Risk Tolerance

Real estate investments carry varying levels of risk, from the relatively stable cash flow of rental properties to the higher risk and potential rewards of house flipping. Evaluate your risk tolerance and ensure that your chosen investment aligns with your comfort level.

3. Available Capital and Financing Options

Different real estate investments require varying levels of capital, from the lower entry barrier of REITs to the substantial upfront costs of commercial properties. It’s crucial to assess your available capital and explore financing options, such as mortgages or investment partnerships, to facilitate your investment strategy.

4. Time Commitment

Some real estate investments, like rental properties or vacation rentals, require significant time and effort for property management and maintenance. Other options, such as REITs or crowdfunding platforms, offer a more passive approach. Consider your time availability and lifestyle preferences when choosing real estate investments.

5. Market Conditions and Location

Real estate markets are cyclical, and economic factors like interest rates, job growth, and population trends can significantly impact investment opportunities and returns. Additionally, location plays a crucial role in determining property values, rental demand, and appreciation potential. Thorough market research and localized analyses are essential for informed investment decisions.

Conclusion: 3 Different Types of Real Estate Investments

The world of real estate investments offers a diverse array of opportunities, catering to different investment goals, risk tolerances, and financial capabilities. 3 Different Types of Real Estate Investments: From residential properties to commercial real estate, and alternative investments like REITs and crowdfunding platforms, investors have a wide range of options to explore.

However, successful real estate investing requires a thorough understanding of the various investment types, 3 Different Types of Real Estate Investments: as well as careful consideration of factors such as investment goals, risk tolerance, available capital, time commitment, and market conditions.

By conducting comprehensive research, seeking professional advice when necessary, and aligning your investment strategy with your personal objectives and resources, 3 Different Types of Real Estate Investments: you can navigate the diverse landscape of real estate investments and pave the way for potential wealth creation and financial success.