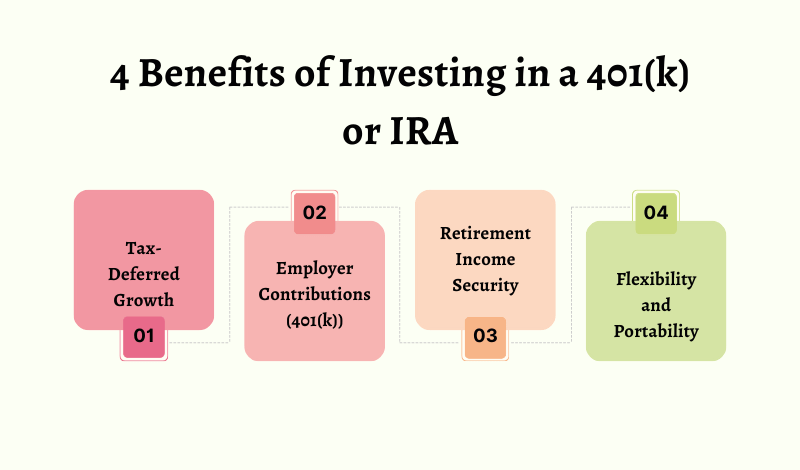

4 benefits of investing in a 401k or IRA

Tax-Deferred Growth:

One of the most significant benefits of investing in a 401k or traditional IRA is tax-deferred growth as part of the 4 benefits of investing in a 401k or IRA. This means that you don’t have to pay taxes on the money you contribute or on the investment earnings until you withdraw the funds in retirement.

Reduced Taxable Income

Contributions to a traditional 401k or IRA are typically tax-deductible, reducing your taxable income for the year you make the contribution as part of the 4 benefits of investing in a 401k or IRA. This can result in lower tax bills and more money in your pocket during your working years.

Compound Growth Potential

By deferring taxes on your investments, your money can grow at a faster rate due to compound interest as part of the 4 benefits of investing in a 401k or IRA. This means that your earnings generate additional earnings, creating a snowball effect over time. The longer you leave your money untouched, the more it can potentially grow.

Employer Contributions (401k):

If you have a 401(k) plan through your employer, you may be eligible for additional contributions from your company as part of the 4 benefits of investing in a 401k or IRA. Many employers offer matching contributions, which can significantly boost your retirement savings.

Free Money

Employer contributions to your 401k are essentially free money as part of the 4 benefits of investing in a 401k or IRA. By contributing enough to receive the full employer match, you’re taking advantage of a valuable benefit that can accelerate your retirement savings.

Automatic Payroll Deductions

Most 401k plans allow you to contribute through automatic payroll deductions, making it easier to save consistently as part of the 4 benefits of investing in a 401k or IRA. This convenience factor can help you develop good savings habits and ensure that you’re regularly contributing to your retirement.

Retirement Income Security:

Both 401ks and IRAs are designed to help you build a substantial nest egg for retirement as part of the 4 benefits of investing in a 401k or IRA. By contributing regularly over the course of your career, you can accumulate a sizable sum to supplement other sources of retirement income, such as Social Security.

Diversification Opportunities

Most 401k and IRA plans offer a wide range of investment options, including stocks, bonds, mutual funds, and more as part of the 4 benefits of investing in a 401k or IRA. This diversity allows you to create a well-rounded portfolio that aligns with your risk tolerance and investment goals.

Catch-Up Contributions

If you’re 50 or older, you can take advantage of “catch-up” contributions, which allow you to contribute additional funds to your 401k or IRA each year as part of the 4 benefits of investing in a 401k or IRA. This can be particularly helpful if you got a late start on retirement savings or want to accelerate your contributions as you approach retirement age.

Flexibility and Portability:

Both 401ks and IRAs offer flexibility and portability, which can be beneficial as your life and career circumstances change as part of the 4 benefits of investing in a 401k or IRA.

Job Changes

If you change jobs, you can typically roll over your 401k balance into an IRA or your new employer’s retirement plan as part of the 4 benefits of investing in a 401k or IRA. This allows you to maintain the tax-deferred status of your savings and continue growing your nest egg.

Roth IRA Option

In addition to traditional IRAs, you can also contribute to a Roth IRA as part of the 4 benefits of investing in a 401k or IRA. With a Roth IRA, you contribute after-tax dollars, but your withdrawals in retirement are tax-free. This can be beneficial if you expect to be in a higher tax bracket during retirement.

Conclusion: 4 benefits of investing in a 401k or IRA

Investing in a 401k or IRA is one of the best strategies for building a secure retirement as part of the 4 benefits of investing in a 401k or IRA. By taking advantage of the tax benefits, employer contributions (if applicable), and compound growth potential, you can accumulate a substantial nest egg to support your desired lifestyle in your golden years. Start contributing early, and make retirement savings a priority – your future self will thank you.