Unraveling the 4 Difference Between Will and Trust: A Comprehensive Guide for Effective Estate Planning

When it comes to estate planning, understanding the 4 difference between Will and Trust is crucial for protecting your assets and ensuring your wishes are honored after you’re gone. These legal instruments serve distinct purposes, and choosing the right one can have far-reaching implications for your loved ones and your legacy. In this comprehensive guide, we’ll explore the nuances of Wills and Trusts, helping you make informed decisions about your estate planning strategy.

What is a Will?

A Will, also known as a last Will and Testament, is a legally binding document that outlines your wishes regarding the distribution of your assets upon your death. It allows you to specify beneficiaries who should receive your property, personal belongings, and other assets. Additionally, a Will enables you to appoint a guardian for minor children and an executor to oversee the implementation of your wishes. In contrast, a Trust is a separate legal entity that holds and manages assets for the benefit of designated beneficiaries. Understanding the 4 difference between Will and Trust is crucial for effective estate planning.

Key Features of a Will:

- Names beneficiaries and the assets they will receive for a Will.

- Appoints an executor to manage and distribute your estate for a Will.

- Can designate guardians for minor children in a Will.

- Only takes effect upon your death for a Will.

- Goes through the probate process, which can be time-consuming and public for a Will.

- Names beneficiaries and the assets they will receive for a Trust.

- Appoints a trustee to manage and distribute the assets in the Trust.

- Cannot designate guardians for minor children in a Trust.

- Can take effect during your lifetime or after your death for a Trust.

- Avoids the probate process, providing privacy and potentially faster distribution for a Trust.

What is a Trust?

A Trust, on the other hand, is a legal arrangement in which a third party, known as a trustee, holds and manages assets on behalf of one or more beneficiaries. Trusts can be established during your lifetime (living Trust) or upon your death (testamentary Trust). They offer a range of benefits, including avoiding probate, providing privacy, and allowing for ongoing asset management, in contrast to a Will which goes through probate and becomes a public record.

Key Features of a Trust:

- Assets are transferred into the Trust and managed by the trustee.

- Can be revocable (changeable during your lifetime) or irrevocable for a Trust.

- Avoids probate, providing privacy and potentially faster asset distribution for a Trust.

- Can specify conditions for asset distribution (e.g., age requirements, education milestones) in a Trust.

- Can provide ongoing management of assets for beneficiaries with special needs or minors through a Trust.

- Names beneficiaries and the assets they will receive in a Will.

- Appoints an executor to manage and distribute your estate in a Will.

- Can designate guardians for minor children in a Will.

- Only takes effect upon your death for a Will.

- Goes through the probate process, which can be time-consuming and public, for a Will.

Similarities Between Wills and Trusts:

While Wills and Trusts serve different purposes, they share some commonalities:

Asset Distribution:

Both Wills and Trusts allow you to specify how your assets should be distributed after your passing.

Beneficiary Designation:

With both Wills and Trusts, you can name beneficiaries who will receive your assets according to your wishes.

Estate Planning:

Wills and Trusts are essential components of a comprehensive estate plan, helping you manage and protect your legacy.

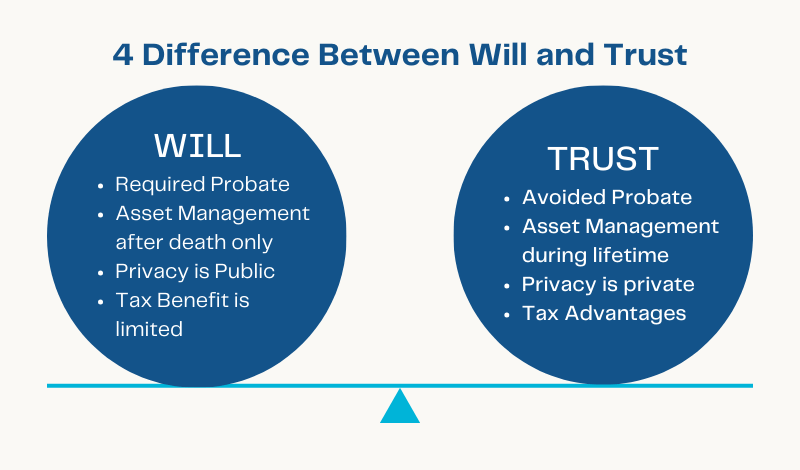

4 Difference Between Will and Trust:

Despite some similarities, there are significant differences between wills and trusts that should be carefully considered:

Probate Process:

A will must go through the probate process, which can be time-consuming, costly, and public. Trusts, on the other hand, generally avoid probate, allowing for a more efficient and private asset distribution.

Asset Management:

While a will only takes effect upon your death, a living trust allows for ongoing asset management during your lifetime. This can be particularly beneficial for those who become incapacitated or require assistance with financial affairs.

Privacy and Control:

Trusts offer greater privacy and control over asset distribution compared to wills, which become public records during the probate process. With a trust, you can specify conditions for asset distribution, such as age requirements or educational milestones.

Tax Implications:

Depending on the type of trust and the assets involved, trusts can provide certain tax advantages, such as minimizing estate taxes or protecting assets from creditors.

When to Use a Will or Trust:

The decision to use a will, a trust, or a combination of both depends on your specific circumstances and goals:

When a Will is Suitable:

- You have a relatively straightforward estate with limited assets

- You want to name guardians for minor children

- You want a simple and cost-effective way to distribute your assets after your passing

When a Trust is Beneficial:

- You have a larger or more complex estate

- You want to avoid probate and maintain privacy

- You need ongoing asset management, such as for a beneficiary with special needs

- You want greater control over asset distribution and protection from creditors

- You seek potential tax advantages or asset protection strategies

Combining Wills and Trusts:

In many cases, it can be advantageous to have both a Will and a Trust as part of a comprehensive estate plan. The Will can serve as a “backup” for any assets that were not properly transferred into the Trust during your lifetime, ensuring that all your wishes are carried out.

Navigating the intricacies of estate planning can be complex, and the decision between a Will and a Trust should be made in consultation with an experienced estate planning attorney. By understanding the 4 difference between Will and Trust and implications of these legal instruments, you can make informed choices that align with your unique circumstances and ensure your legacy is protected for generations to come.

Conclusion:

Understanding the 4 difference between Will and Trust is essential for effective estate planning. While a Will provides a straightforward way to distribute your assets upon your passing, a Trust offers greater flexibility, privacy, and control over asset management. By carefully evaluating your specific needs and goals, you can choose the most suitable approach or combine both Wills and Trusts for a comprehensive estate plan. Seek professional guidance to navigate the complexities and safeguard your legacy for your loved ones.