Maximizing Your Savings: 5 Best Ways to Save Money on Taxes

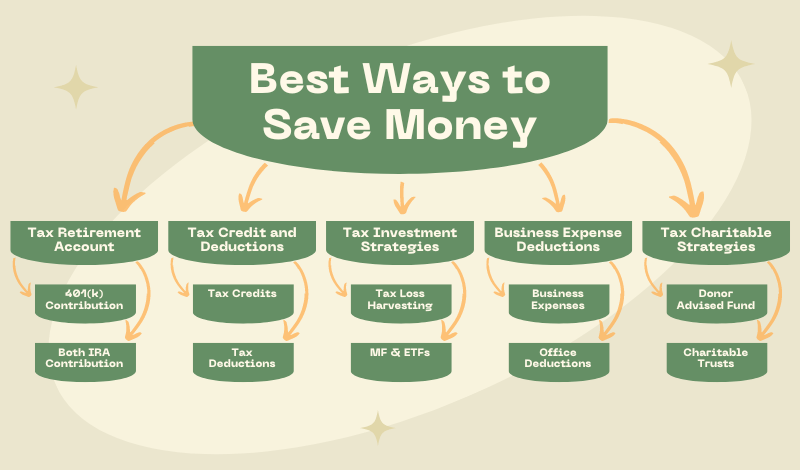

5 Best Ways to Save Money on Taxes: Taxes are an inevitable part of life, but that doesn’t mean you have to pay more than necessary. By understanding and taking advantage of various tax strategies, including maximizing deductions, leveraging tax credits, contributing to tax-advantaged accounts, bunching expenses, and tax loss harvesting, you can potentially save thousands of dollars each year and keep more of your hard-earned money in your pocket. In this comprehensive guide, we’ll explore the 5 best ways to save money on taxes, empowering you to make informed decisions and optimize your financial situation.

1. Best Ways to Save Money on Taxes: Contribute to Tax-Advantaged Retirement Accounts

One of the 5 best ways to save money on taxes is by contributing to tax-advantaged retirement accounts, such as 401(k)s, Traditional IRAs, and Roth IRAs. Maximizing contributions to these accounts allows you to defer taxes on the money you contribute and potentially reduce your taxable income for the year.

401(k) Contributions

Contributions to a 401(k) plan are made with pre-tax dollars, reducing your taxable income for the year. This is one of the 5 best ways to save money on taxes. The money in your 401(k) account grows tax-deferred, and you’ll only pay taxes on the withdrawals during retirement when you’re likely in a lower tax bracket.

Traditional IRA Contributions

Similar to a 401(k), contributions to a Traditional IRA are tax-deductible, lowering your taxable income for the year. This is one of the 5 best ways to save money on taxes. The investment growth in your Traditional IRA is also tax-deferred until you start taking withdrawals in retirement.

Roth IRA Contributions

Contributions to a Roth IRA are made with after-tax dollars, but your withdrawals in retirement are tax-free. Utilizing a Roth IRA is one of the 5 best ways to save money on taxes, as this can be a valuable strategy if you expect to be in a higher tax bracket during retirement.

2. Maximize Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability, so it’s essential to take advantage of all the opportunities available to you. Maximizing tax credits and deductions is one of the 5 best ways to save money on taxes. By claiming eligible credits and deductions, you can lower your taxable income and ultimately pay less in taxes.

Tax Credits

Tax credits directly reduce the amount of tax you owe, dollar-for-dollar. Claiming tax credits is one of the 5 best ways to save money on taxes. Common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, the American Opportunity Tax Credit for education expenses, and various energy-efficient home improvement credits.

Tax Deductions

Tax deductions reduce your taxable income, effectively lowering the amount of tax you owe. Maximizing tax deductions is one of the 5 best ways to save money on taxes. Some common deductions include mortgage interest, charitable donations, state and local taxes (up to a certain limit), medical expenses (if they exceed a certain percentage of your income), and business expenses for self-employed individuals.

3. Consider Tax-Efficient Investing Strategies

The way you invest can also impact your tax liability. Implementing tax-efficient investing strategies is one of the 5 best ways to save money on taxes, as it can help minimize the taxes you pay on your investment gains.

Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have experienced a loss to offset capital gains from other investments, reducing your overall tax burden. This strategy is one of the 5 best ways to save money on taxes by minimizing the taxes owed on your investment gains.

Tax-Efficient Mutual Funds and ETFs

Investing in tax-efficient mutual funds and exchange-traded funds (ETFs) can help minimize the amount of capital gains distributions you receive, which are taxable events. This is one of the 5 best ways to save money on taxes by keeping your investment taxes low.

Asset Location

Asset location, which refers to the strategic placement of different types of investments across various accounts (taxable, tax-deferred, and tax-exempt) to maximize tax efficiency, is one of the 5 best ways to save money on taxes. By properly locating your assets, you can minimize the drag of taxes on your overall investment returns.

4. Plan for Business Expenses and Deductions

If you’re a small business owner or self-employed individual, taking advantage of numerous tax-saving opportunities through business expenses and deductions is one of the 5 best ways to save money on taxes. Properly claiming eligible business deductions can significantly reduce your taxable income and tax liability.

Deductible Business Expenses

Deductible business expenses can significantly reduce your taxable income, and claiming them is one of the 5 best ways to save money on taxes. These may include office supplies, equipment, travel expenses, advertising costs, and employee salaries and benefits. Properly documenting and deducting eligible business expenses can provide substantial tax savings.

Home Office Deduction

If you use a portion of your home regularly and exclusively for business purposes, you may be eligible for the home office deduction, which can provide substantial tax savings. Claiming the home office deduction is one of the 5 best ways to save money on taxes for small business owners and self-employed individuals.

Retirement Plan Contributions for Self-Employed

If you use a portion of your home regularly and exclusively for business purposes, you may be eligible for the home office deduction, which can provide substantial tax savings. Claiming the home office deduction is one of the 5 best ways to save money on taxes for small business owners and self-employed individuals.

5. Consider Tax-Efficient Charitable Giving Strategies

If you’re charitably inclined, there are several tax-efficient ways to make donations that can provide tax benefits. Utilizing charitable donations strategically is one of the 5 best ways to save money on taxes. By donating cash, appreciated securities, or even required minimum distributions from retirement accounts to qualified charities, you can potentially claim deductions and minimize taxes owed.

Donor-Advised Funds

Donor-Advised Funds (DAFs) allow you to make a charitable contribution and take an immediate tax deduction, while retaining the ability to recommend grants to qualified charities over time.

Qualified Charitable Distributions (QCDs)

If you’re over 70½ years old, you can make Qualified Charitable Distributions (QCDs) directly from your IRA to eligible charities, which can count toward your required minimum distributions and potentially reduce your taxable income.

Charitable Trusts

Charitable trusts, such as Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs), can provide tax benefits while supporting charitable causes and potentially passing assets to beneficiaries.

Saving money on taxes requires a proactive approach and a thorough understanding of the various strategies available. By contributing to tax-advantaged accounts, maximizing credits and deductions, implementing tax-efficient investing strategies, planning for business expenses, and exploring charitable giving opportunities, you can potentially reduce your tax liability and keep more of your hard-earned money working for you.

It’s important to note that tax laws and regulations are subject to change, and individual circumstances may vary. Consulting with a qualified tax professional or financial advisor can help ensure you’re taking advantage of all applicable tax-saving opportunities and developing a comprehensive tax strategy tailored to your specific needs.