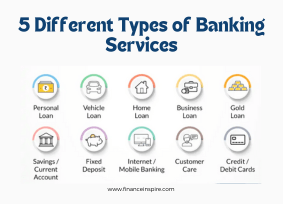

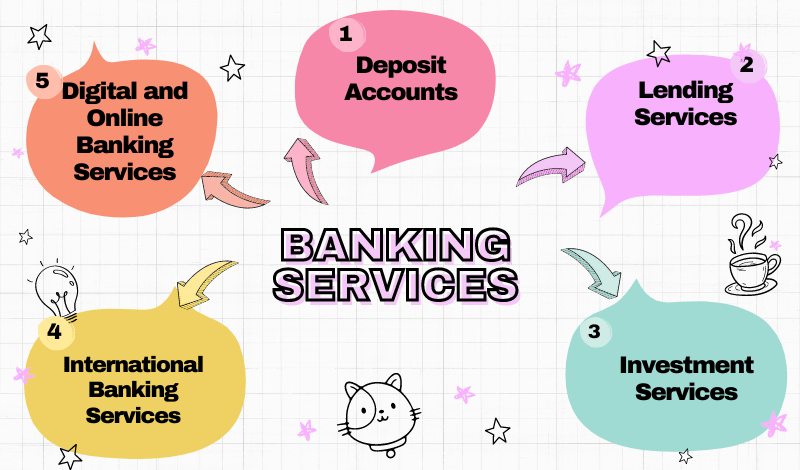

What are the Different Types of Banking Services ?

Introduction

Banking is an integral part of modern life, providing individuals and businesses with a wide range of financial services. From managing personal finances to facilitating large-scale transactions, banks play a crucial role in the global economy. As the financial landscape continues to evolve, banks have expanded their offerings to cater to the diverse needs of their customers. In this article, we’ll explore the 5 Different Types of Banking Services, shedding light on the various options consumers and businesses can consider.

1. Deposit Accounts

5 Different Types of Banking Services, Deposit Accounts: One of the most fundamental banking services is the provision of deposit accounts. These accounts allow customers to securely store their funds while earning interest and accessing their money conveniently.

1. Checking Accounts: Checking accounts are designed for everyday transactions, such as paying bills, making purchases, and receiving payments. These accounts typically offer features like debit cards, online banking, and mobile banking for easy access to funds.

2. Savings Accounts: Savings accounts are designed for accumulating and growing funds over time. They typically offer higher interest rates than checking accounts, incentivizing customers to save and build their financial reserves.

3. Money Market Accounts: Money market accounts combine features of both checking and savings accounts, offering higher interest rates than traditional savings accounts while allowing limited check-writing capabilities.

4. Certificates of Deposit (CDs): CDs are time-based deposit accounts that offer higher interest rates in exchange for keeping the funds deposited for a predetermined period, typically ranging from a few months to several years.

2. Lending Services

5 Different Types of Banking Services, Lending Services: Banks play a crucial role in providing access to credit and lending services for individuals and businesses alike.

1. Mortgages: Mortgage loans are designed to help individuals and families finance the purchase of a home or real estate property. Banks offer various mortgage options, including fixed-rate and adjustable-rate mortgages, to cater to different financial situations and preferences.

2. Personal Loans: Personal loans are unsecured loans that can be used for a variety of purposes, such as consolidating debt, financing major purchases, or covering unexpected expenses.

3. Business Loans: Banks offer a range of business loans to support the growth and operations of companies. These may include term loans, lines of credit, equipment financing, and commercial real estate loans.

4. Credit Cards: Credit cards provide a convenient way for individuals and businesses to access revolving credit for purchases and expenses. Banks offer various credit card options with different rewards programs, interest rates, and credit limits.

3. Investment Services

5 Different Types of Banking Services, Investment Services: in addition to traditional banking services, many banks also offer investment services to help customers grow and manage their wealth.

1. Brokerage Accounts: Banks may provide brokerage services, allowing customers to buy and sell stocks, bonds, mutual funds, and other investment products through a dedicated brokerage platform.

2. Retirement Accounts: Banks often offer retirement account options, such as Individual Retirement Accounts (IRAs) and employer-sponsored plans like 401(k)s, to help individuals save for their golden years.

3. Investment Advisory: Some banks offer investment advisory services, providing customers with professional guidance on portfolio management, asset allocation, and financial planning.

4. Wealth Management: For high-net-worth individuals and families, banks may offer comprehensive wealth management services, including investment management, tax planning, estate planning, and philanthropic advisory.

4. International Banking Services

1. Foreign Currency Exchange: Banks offer foreign currency exchange services, allowing customers to convert their local currency into foreign currencies for travel, international purchases, or investments abroad.

2. International Wire Transfers: Banks facilitate international wire transfers, enabling customers to send and receive funds across borders securely and efficiently.

3. Letters of Credit: For businesses engaged in international trade, banks issue letters of credit, which serve as a guarantee of payment for goods or services, mitigating risk and facilitating cross-border transactions.

4. Expatriate Banking: Some banks offer specialized banking services tailored to the needs of expatriates, such as multi-currency accounts, international investment options, and specialized tax and financial planning advice.

5. Digital and Online Banking Services

5 Different Types of Banking Services, Online and Mobile Banking: In the digital age, banks have embraced technology to offer convenient and accessible banking services through online and mobile platforms.

1. Online Banking: Most banks now provide online banking platforms, allowing customers to manage their accounts, transfer funds, pay bills, and access various banking services from the comfort of their homes or offices.

2. Mobile Banking: With the proliferation of smartphones and mobile devices, banks have developed mobile banking apps to enable customers to bank on the go, checking account balances, making transfers, and even depositing checks using their mobile devices.

3. Digital Wallets and Payments: Banks are integrating digital wallet and mobile payment solutions, such as Apple Pay, Google Pay, and Samsung Pay, to provide customers with secure and convenient ways to make purchases and conduct transactions using their mobile devices.

4. Personal Finance Management Tools: Some banks offer personal finance management tools, either integrated into their online or mobile banking platforms or as standalone applications, to help customers track their spending, create budgets, and achieve their financial goals.

Conclusion: 5 Different Types of Banking Services

5 Different Types of Banking Services: Banking services have evolved significantly to meet the diverse financial needs of individuals and businesses in today’s world. From traditional deposit accounts and lending services to investment and wealth management solutions, banks offer a wide array of options. Additionally, the rise of digital and online banking has revolutionized the way customers interact with their financial institutions, providing convenience and accessibility like never before. As the banking industry continues to innovate, customers can expect even more tailored and personalized services to help them achieve their financial goals effectively and efficiently.