The Beginner’s Guide to Investing in Real Estate Investment Trusts (REITs)

Are you interested in tapping into the lucrative real estate market but don’t want the hassle of being a landlord? Real Estate Investment Trusts (REITs) could be the perfect investment vehicle for you, especially 5 REITs to start Investing for Passive Income. REITs allow you to invest in income-producing real estate without the headaches of direct property ownership. This guide will walk you through everything you need to know about investing in REITs, their benefits, risks, and how to get started.

What Are REITs?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate, making REITs like the 5 REITs to start Investing for Passive Income attractive options. By law, REITs must distribute at least 90% of their taxable income to shareholders in the form of dividends. This unique structure makes REITs an attractive option for investors seeking steady income streams and potential long-term capital appreciation.

REITs invest in a variety of real estate sectors, including:

- Residential (apartments, student housing, manufactured homes)

- Commercial (office buildings, shopping centers, hotels)

- Industrial (warehouses, distribution centers)

- Healthcare (hospitals, nursing homes, medical offices)

- Mortgage REITs (invest in mortgages and mortgage-backed securities)

Benefits of Investing in REITs

1. Diversification:

REITs to start Investing for Passive Income in REITs provide investors with exposure to the real estate market without the need to purchase and manage physical properties. This diversification can help reduce overall portfolio risk.

2. Liquidity:

REITs to start Investing for Passive Income in Unlike direct real estate investments, publicly-traded REITs are highly liquid, meaning you can buy and sell shares easily on major stock exchanges.

3. Passive Income:

REITs to start Investing for Passive Income in REITs are required to distribute at least 90% of their taxable income to shareholders, providing a steady stream of passive income through dividend payments.

4. Potential for Capital Appreciation:

REITs to start Investing for Passive Income in In addition to dividend income, REITs also offer the potential for capital appreciation as the underlying real estate assets appreciate in value over time.

5. Professional Management:

REITs to start Investing for Passive Income in REITs are managed by teams of real estate professionals who are responsible for acquiring, managing, and maintaining the properties in the portfolio.

Risks of Investing in REITs

REITs to start Investing for Passive Income in While REITs offer several benefits, they also come with inherent risks that investors should be aware of:

1. Interest Rate Risk:

REITs can be sensitive to changes in interest rates, as higher rates can increase borrowing costs and potentially reduce property values.

2. Market Risk:

Like stocks, REITs are subject to market fluctuations and can experience periods of volatility, particularly during economic downturns or recessions.

3. Concentration Risk:

Some REITs may have a high concentration in a particular real estate sector or geographic region, increasing their exposure to industry-specific or localized risks.

4. Leverage Risk:

REITs often use debt financing to acquire properties, which can amplify potential gains but also increase risk during economic downturns.

5. Tax Implications:

While REIT dividends are generally taxed at lower rates than ordinary income, they can still have tax implications for investors, particularly if held in non-retirement accounts.

How to Invest in REITs

REITs to start Investing for Passive Income in There are several ways to invest in REITs, each with its own advantages and considerations:

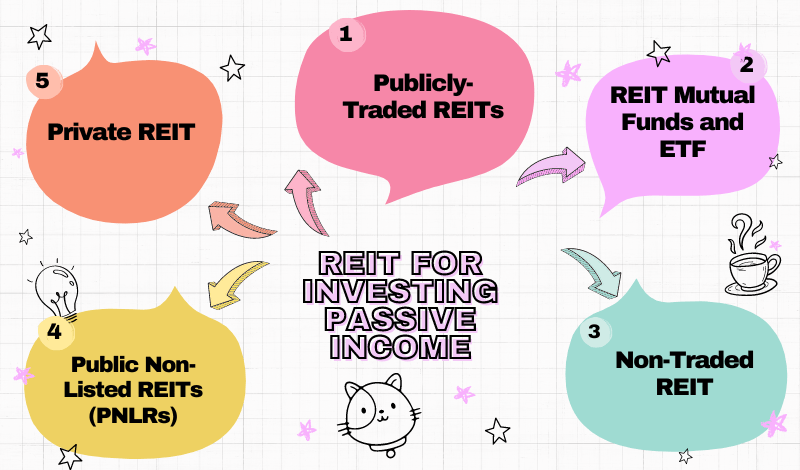

1. Publicly-Traded REITs:

Publicly-traded REITs are listed on major stock exchanges and can be bought and sold like regular stocks through a brokerage account. This is the most common and accessible way for individual investors to invest in REITs. Some popular publicly-traded REITs include Prologis (PLD), Realty Income (O), and American Tower Corp (AMT).

2. REIT Mutual Funds and ETFs:

For investors seeking diversification across multiple REITs, mutual funds and exchange-traded funds (ETFs) that specialize in REITs can be an excellent option. These funds provide exposure to a basket of REITs, reducing the risk of investing in a single REIT. Examples include the Vanguard Real Estate ETF (VNQ) and the Fidelity Real Estate Investment Portfolio (FRESX).

3. Non-Traded REITs:

Non-traded REITs are not listed on public stock exchanges and are typically sold through brokers or financial advisors. These REITs can provide access to specialized real estate sectors or projects but may have higher fees and lower liquidity than publicly-traded counterparts.

4. Public Non-Listed REITs (PNLRs):

PNLRs are a hybrid between publicly-traded and non-traded REITs. They are registered with the SEC but not listed on a national securities exchange. PNLRs can offer potentially higher yields but may also have lower liquidity.

5. Private REITs:

Private REITs are typically only available to accredited investors and institutions. These REITs are not registered with the SEC and are not subject to the same reporting requirements as public REITs, potentially offering more flexibility but also heightened risk.

Tips for Investing in REITs

1. Understand Your Investment Goals:

Determine whether you’re investing in REITs primarily for income, capital appreciation, or a combination of both. This will help you choose the appropriate REIT sectors and investment vehicles.

2. Diversify Your REIT Portfolio:

Don’t put all your eggs in one basket. Consider investing in a mix of REIT sectors, geographic regions, and investment vehicles to mitigate risk.

3. Monitor REIT Performance:

Regularly review the performance of your REIT investments, including dividend yields, occupancy rates, and property acquisitions or dispositions.

4. Reinvest Dividends:

Many REITs offer dividend reinvestment plans (DRIPs) that allow you to automatically reinvest dividends to purchase additional shares, compounding your returns over time.

5. Consider Tax Implications:

Understand the tax treatment of REIT dividends and consult with a tax professional to ensure compliance and potential tax optimization strategies.

6. Invest for the Long-Term:

While REITs can experience short-term volatility, they have historically performed well over longer periods, making them suitable for long-term investment horizons.

Conclusion: 5 REITs to start Investing for Passive Income

REITs to start Investing for Passive Income in In conclusion, investing in Real Estate Investment Trusts (REITs) can be an excellent way to diversify your portfolio, generate passive income, and gain exposure to the real estate market without the hassles of direct property ownership. By understanding the benefits, risks, and various investment vehicles available, you can make informed decisions and potentially reap the rewards of this unique asset class. Whether you’re a seasoned investor or just starting out, REITs can be a valuable addition to your investment strategy.