5 Steps to invest in cryptocurrency

Cryptocurrency has been one of the hottest investment opportunities in recent years, with Bitcoin and other digital currencies like Ethereum making early investors incredibly wealthy. However, the crypto world can also be confusing, volatile, and risky for new investors. If you’re wondering how to invest in cryptocurrency safely and effectively, this guide will walk you through the 5 Steps to Invest in Cryptocurrency.

Understanding Cryptocurrency: 5 Steps to Invest in Cryptocurrency

Before investing, it’s important to understand what cryptocurrency actually is and how it works. Cryptocurrency is a form of digital money that uses cryptography to secure transactions and control the creation of new units. Unlike traditional fiat currencies like the U.S. dollar, no government or central authority backs or regulates most cryptocurrencies. 5 Steps to Invest in Cryptocurrency.

Instead, cryptocurrencies are decentralized and run on a technology called blockchain, which is essentially a shared public ledger where all transactions are recorded and validated by a network of computers solving complex mathematical problems. Bitcoin was the first major cryptocurrency, launched in 2009, and it remains the largest and most well-known today. However, there are now thousands of other “altcoins” like Ethereum, Litecoin, and Ripple available for trading and investment. 5 Steps to Invest in Cryptocurrency.

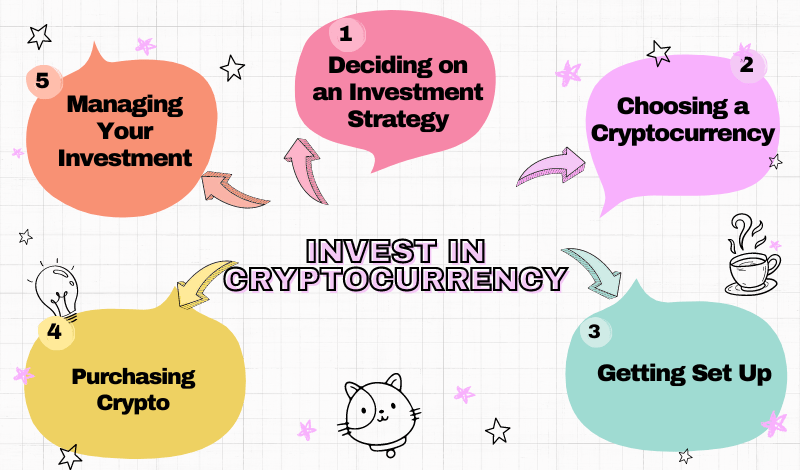

1. Deciding on an Investment Strategy:

Like any investment, there are a few key strategies you can take when investing in cryptocurrency:

1. Buy and Hold: The “buy and hold” approach means purchasing cryptocurrency as a long-term investment, with the expectation that it will significantly increase in value over time. This was an extremely lucrative strategy for early Bitcoin investors. However, it also carries significant risk given crypto’s volatility.

2. Trading: Rather than holding for the long-term, many crypto investors actively trade cryptocurrencies, trying to buy low and sell high to profit from short-term price movements. This takes more effort but allows you to capitalize on market swings.

3. Mining: Instead of purchasing cryptocurrency, you can also try “mining” it by contributing your computer’s processing power to validate transactions on the blockchain network. As a reward, miners receive small amounts of cryptocurrency.

No matter which approach you take, it’s wise to only invest money you can truly afford to lose, given crypto’s high-risk nature, at least until the market matures.

2. Choosing a Cryptocurrency:

With thousands of options, deciding which cryptocurrency to invest in can feel overwhelming. Most experts recommend starting with Bitcoin and Ethereum, the two largest and most established cryptocurrencies. Bitcoin is the closest thing to “digital gold” and has the longest proven track record, while Ethereum is popular for its smart contract capabilities and the base for many decentralized apps.

Steps to Invest in Cryptocurrency, Beyond those two, do plenty of research on a coin’s technology, real-world use cases, developer activity, market cap, and community strength before investing significant sums. Watch out for excessive hype, potential scams, and “meme coins” with little substance behind them.

3. Getting Set Up:

To purchase cryptocurrency, you’ll need to set up a “cryptocurrency wallet” to store your coins or tokens. While small amounts can be kept in an online exchange wallet, for larger investments, most experts recommend a secure hardware or paper wallet for cold storage offline.

Steps to Invest in Cryptocurrency, Popular software wallet options include the official wallet of each cryptocurrency you purchase (e.g. the Bitcoin Core wallet) or multi-currency options like Exodus, Electrum, and Mycelium. For maximum security, hardware wallets like Trezor or Ledger are considered extremely secure cold storage devices.

Steps to Invest in Cryptocurrency, You’ll also need to set up an account on a cryptocurrency exchange like Coinbase, Kraken, or Gemini to convert traditional currency into crypto and vice versa. These exchanges act like stock brokerage accounts for crypto. Many also allow you to store your coins in an online wallet, though experts caution against holding large sums on exchanges due to hacking risks.

4. Purchasing Crypto:

Once you’ve set up a wallet and exchange account, you’re ready to purchase cryptocurrency using traditional currency like U.S. dollars. Most exchanges allow bank transfers, debit card, or even PayPal payments, though bank wires or cryptocurrency funding sources incur lower fees.

Steps to Invest in Cryptocurrency, For your first purchase, transfer a small amount to test the process. Then, determine how much you feel comfortable investing based on your budget and risk tolerance. Most experts recommend keeping cryptocurrency holdings to under 5% of your overall investment portfolio given the volatility.

5. Managing Your Investment:

After purchasing, make sure to store your cryptocurrency safely and securely. Hardware wallets, paper wallets stored properly, and 2FA-enabled software wallets offer robust security. While online exchange wallets are convenient, avoid leaving large sums unprotected on an exchange.

Steps to Invest in Cryptocurrency, Pay close attention to factors like developer updates, new partnerships, regulation changes, and market momentum that can impact a cryptocurrency’s price. For trading, learn to read pricing charts, volume indicators, moving averages, and other signals. Traditional investment strategies like portfolio diversification and dollar-cost averaging can also help smooth volatility.

Steps to Invest in Cryptocurrency, Overall, cryptocurrency investing still carries significant risk but also offers the opportunity for potential major returns. By understanding the basics, choosing solid projects, starting small, and employing prudent security practices, you can gain exposure to this innovative new asset class while limiting downside.