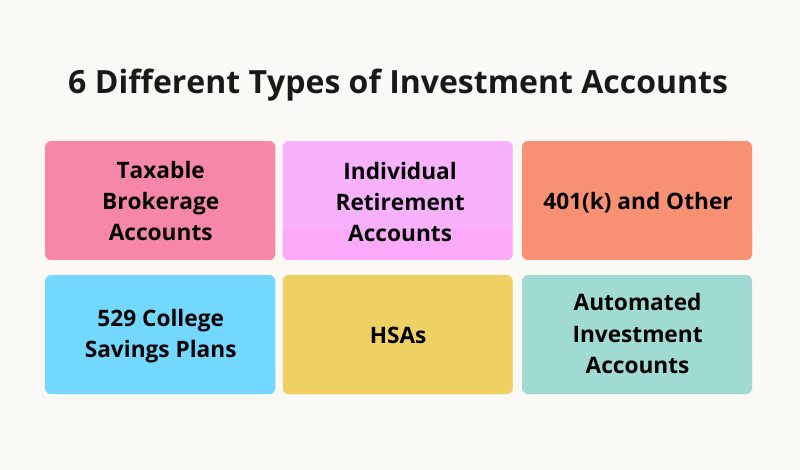

6 Different Types of Investment Accounts: A Comprehensive Guide

Are you looking to grow your money for future goals such as retirement, your child’s education, or a large purchase? Investing is one of the best ways to build wealth over time. However, with so many different types of investment accounts available, such as 401(k), IRA, 529 plan, brokerage account, HSA, and annuity – which are 6 different types of investment accounts – it can be overwhelming to choose the right one. Understanding the features, tax implications, and eligibility requirements of each account type is crucial to making an informed decision that aligns with your financial goals.

Understanding the various account options, such as the 6 different types of investment accounts like 401(k)s, IRAs, 529 plans, brokerage accounts, HSAs, and annuities, is crucial for selecting the right ones to meet your specific investing needs and making the most of your hard-earned money. In this comprehensive guide, we’ll explore the different types of investment accounts to help you make an informed decision.

1. Taxable Brokerage Accounts

A taxable brokerage account is one of the 6 different types of investment accounts. It is a basic investment account that allows you to buy and sell a wide range of investments like stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. These accounts have no tax advantages – you’ll pay annual taxes on any interest, dividends, or realized capital gains each year.

The upside of taxable brokerage accounts, which are one of the 6 different types of investment accounts, is that you can access your money at any time without penalties, and you have unlimited flexibility in how you invest. They are ideal for short-term or non-retirement investment goals.

2. Individual Retirement Accounts (IRAs)

IRAs are tax-advantaged accounts designed specifically for retirement savings. There are two main types:(Traditional IRA & Roth IRA)

Traditional IRA: Contributions are made pre-tax, lowering your current taxable income. The money grows tax-deferred, and you pay income tax on withdrawals in retirement.

Roth IRA: Contributions are made after-tax, but withdrawals in retirement are completely tax-free if certain conditions are met.

Both types of IRAs allow you to invest in stocks, bonds, mutual funds, ETFs, and more inside a tax-sheltered account. However, there are income limits for contributions, and early withdrawals before age 59 ½ may trigger penalties.

3. 401(k) and Other Employer-Sponsored Retirement Plans

If your employer offers a 401(k) or 403(b) retirement plan, you have a powerful wealth-building tool at your disposal. You can automatically contribute a portion of each paycheck, often receiving an employer match, and let that money grow tax-deferred over decades. Like a traditional IRA, you’ll eventually pay income tax on withdrawals in retirement.

These employer-sponsored plans typically offer a selection of mutual funds to choose from, though some also allow investing in individual stocks and ETFs. There are strict annual contribution limits, but they are higher than IRAs.

4. 529 College Savings Plans

529 plans allow you to invest for qualified education expenses in a tax-advantaged account. Contributions are made after-tax, but earnings grow tax-deferred. Withdrawals are tax-free if used for expenses like tuition, fees, room and board, books, and more.

While 529 plans are commonly used for a child’s college costs, some states allow using the funds tax-free for K-12 tuition as well. Investment options typically include mutual funds and ETFs. Contributions may also be eligible for state tax deductions.

5. Health Savings Accounts (HSAs)

If you have a high-deductible health insurance plan, you may be able to open a Health Savings Account (HSA). These unique accounts offer a triple tax advantage:

1) Contributions are tax-deductible

2) Money grows tax-deferred

3) Withdrawals are tax-free if used for qualified medical expenses

HSAs allow you to invest much like a 401(k), often in mutual funds. The money can be used tax-free for medical costs in any year – not just the year you contributed. Unused funds also continue growing tax-free for future medical costs in retirement.

6. Automated Investment Accounts (Robo-Advisors)

In recent years, automated investing solutions like robo-advisors have grown in popularity. With these types of accounts, you’ll complete a risk questionnaire, and based on your goals and risk tolerance, the provider will automatically invest your money in a diversified portfolio using low-cost funds.

There are robo-advisor options for taxable brokerage accounts, IRAs, and even some 401(k) plans. They offer an easy, hands-off way to invest, particularly for beginners. Fees are typically low as well.

Choosing the Right Investment Accounts

The best investment accounts for you depend on your goals, tax situation, investment preferences, and timeline. For long-term goals like retirement, tax-advantaged accounts such as IRAs, 401(k)s, and HSAs, which are three of the 6 different types of investment accounts, are wise options to maximize growth.

For shorter time horizons like saving for a home down payment, a taxable brokerage account, which is one of the 6 different types of investment accounts, provides flexibility. And education goals are ideal for using a 529 plan, another of the 6 different types of investment accounts.

It’s generally advisable to use a mix of the 6 different types of investment accounts, taking advantage of all available tax benefits. Maximizing tax-advantaged accounts like 401(k)s, IRAs, and HSAs first before investing in taxable accounts can potentially supercharge your returns over decades. Working with a qualified financial advisor can also help ensure you’re optimizing your investment accounts appropriately across the 6 different types available.

Conclusion: 6 different types of investment accounts

In conclusion, understanding the 6 different types of investment accounts such as 401(k)s, IRAs, 529 plans, brokerage accounts, HSAs, and annuities is crucial for achieving your financial goals. By carefully considering your needs and taking advantage of the tax benefits offered by various accounts, you can maximize your investment returns and secure your financial future.