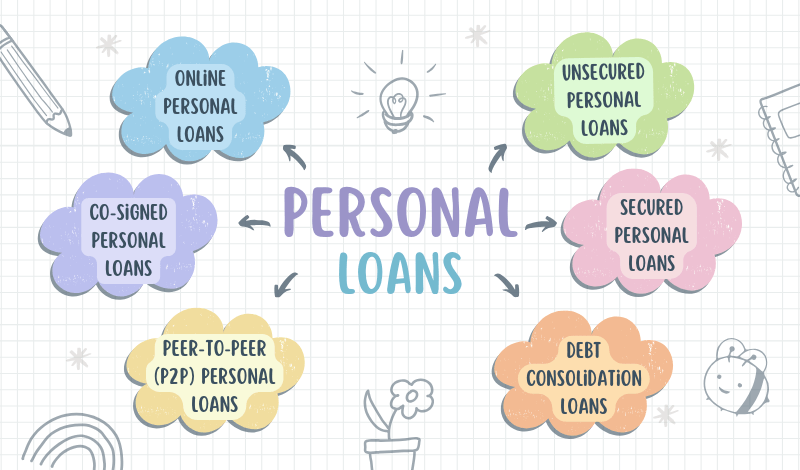

Understanding 6 Different Types of Personal Loans: Exploring the Diverse World of Personal Loans

In today’s fast-paced financial landscape, personal loans have become an increasingly popular option for individuals seeking to fund a wide range of needs. From consolidating debt to financing major purchases or unexpected expenses, personal loans offer a flexible financing solution tailored to individual circumstances. Additionally, personal loans can potentially help with credit score improvement by demonstrating responsible borrowing and repayment behavior. However, not all personal loans are created equal. In this comprehensive article, we’ll delve into the 6 Different Types of Personal Loans available, empowering you to make informed decisions that align with your financial goals and requirements.

1. Unsecured Personal Loans: One of the 6 Different Types of Personal Loans

Unsecured personal loans are perhaps the most common and widely available type of personal loan, which falls under the 6 Different Types of Personal Loans. These loans are not backed by any collateral, such as a home or a car, and are instead based on your creditworthiness and ability to repay the loan. Lenders typically consider factors such as credit score, income, and existing debt when determining loan eligibility and interest rates.

Advantages of Unsecured Personal Loans

– No collateral required, reducing the risk of asset loss

– Flexible loan amounts and repayment terms

– Faster application and approval process compared to secured loans

Considerations for Unsecured Personal Loans

– Higher interest rates compared to secured loans due to increased risk for lenders

– Strict credit and income requirements may limit eligibility for some borrowers

2. Secured Personal Loans

Secured personal loans, as the name suggests, require collateral to secure the loan, which is another type included in the 6 Different Types of Personal Loans. This collateral can range from a vehicle, home equity, or other valuable assets. By offering collateral, borrowers may be able to access larger loan amounts and potentially secure more favorable interest rates, as the lender has a lower risk of default.

Advantages of Secured Personal Loans

– Lower interest rates compared to unsecured loans due to reduced risk for lenders

– Access to larger loan amounts based on the value of the collateral

– Potential eligibility for borrowers with limited credit history or lower credit scores

Considerations for Secured Personal Loans

– Risk of losing the collateral asset in case of default

– Additional paperwork and documentation required for collateral evaluation

3. Debt Consolidation Loans

Debt consolidation loans are a specific type of personal loan included in the 6 Different Types of Personal Loans. These loans are designed to help borrowers streamline and manage multiple outstanding debts. By consolidating various debts, such as credit card balances, student loans, or other personal loans, into a single loan, borrowers can potentially benefit from a lower overall interest rate and a simplified repayment schedule.

Advantages of Debt Consolidation Loans

– Simplifies debt management by consolidating multiple payments into one

– Potential for lower interest rates, resulting in savings over time

– Improved credit utilization ratio by paying off revolving credit balances

Considerations for Debt Consolidation Loans

– Strict credit and income requirements to qualify

– Potential for extending the repayment timeline and paying more interest over the loan’s lifetime

4. Peer-to-Peer (P2P) Personal Loans

Peer-to-peer (P2P) personal loans are a relatively new and innovative form of lending included in the 6 Different Types of Personal Loans. These loans are facilitated by online platforms that connect borrowers directly with individual or institutional investors. These platforms use proprietary algorithms to evaluate borrowers’ creditworthiness and facilitate the lending process.

Advantages of P2P Personal Loans

– Potentially lower interest rates compared to traditional lenders

– Faster application and approval process

– Access to funding for borrowers with diverse credit profiles

Considerations for P2P Personal Loans

– Limited borrowing amounts compared to traditional lenders

– Potential for higher origination fees or closing costs

– Lack of in-person support or guidance from lenders

5. Co-Signed Personal Loans

Co-signed personal loans, one of the 6 Different Types of Personal Loans, involve a third party, typically a family member or close friend, who agrees to share the responsibility for repaying the loan. By having a co-signer with a strong credit history and income, borrowers with limited credit or income may be able to qualify for a personal loan or secure more favorable terms.

Advantages of Co-Signed Personal Loans

– Increased chances of loan approval for borrowers with limited credit or income

– Potential for lower interest rates due to shared responsibility

– Access to larger loan amounts based on the co-signer’s creditworthiness

Considerations for Co-Signed Personal Loans

– Co-signer’s credit and financial responsibility are linked to the loan

– Potential for damaging the co-signer’s credit in case of default

– Strained personal relationships if repayment issues arise

6. Online Personal Loans

Online personal loans, also known as digital or fintech loans, are one of the 6 Different Types of Personal Loans offered by non-traditional lenders operating primarily through online platforms. These lenders often use alternative data and advanced algorithms to evaluate borrowers’ creditworthiness, making the application and approval process more streamlined and accessible.

Advantages of Online Personal Loans

– Convenient and fast application process, often with instant decisions

– Potential for more flexible credit requirements

– Access to funding for borrowers with diverse credit profiles

Considerations for Online Personal Loans

– Potentially higher interest rates compared to traditional lenders

– Limited loan amounts and repayment terms

– Lack of physical branches or in-person support

Conclusion

Personal loans come in various forms, which can be categorized under the 6 Different Types of Personal Loans, each designed to cater to different financial needs and circumstances. Whether you’re seeking an unsecured loan for debt consolidation, a secured loan for a major purchase, or exploring innovative options like P2P or online personal loans, understanding the advantages and considerations of each type is crucial for making an informed decision.

Before applying for one of the 6 Different Types of Personal Loans, it’s essential to carefully evaluate your financial situation, credit profile, and repayment capacity. Additionally, comparing offers from multiple lenders can help you secure the most favorable terms and ensure that the personal loan aligns with your overall financial goals and long-term financial well-being.