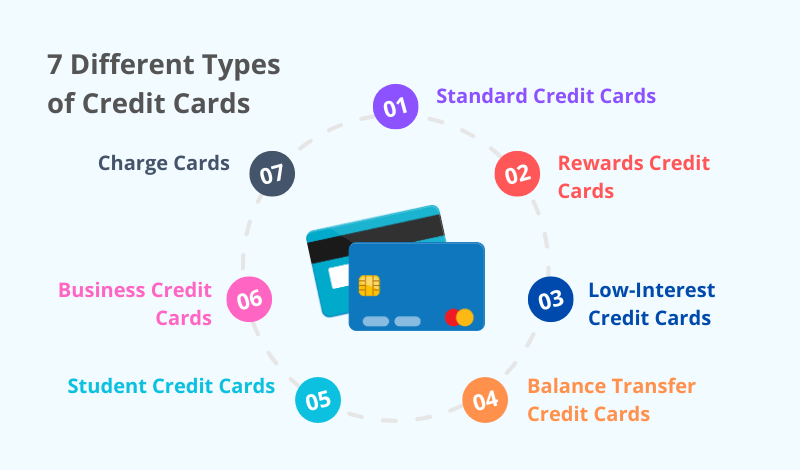

Navigating the World of Credit Cards: 7 Different Types of Credit Cards for Good Credit Score

In today’s financial landscape, credit cards have become an integral part of our daily lives. From making purchases to building credit history, these ubiquitous plastic cards offer convenience and flexibility. However, not all credit cards are created equal. There are 7 different types of credit cards designed to cater to different needs and financial situations. In this comprehensive article, we’ll explore the 7 different types of credit cards available, helping you make an informed decision when choosing the right card for your lifestyle.

1. Standard Credit Cards: One of the 7 Different Types of Credit Cards

Standard credit cards are the most common and widely used type, one of the 7 different types of credit cards. They typically offer a basic set of features and benefits, such as the ability to make purchases, earn rewards points or cash back, and build credit history. Standard credit cards come in various forms, including:

1. Unsecured Credit Cards: These are the most common type of standard credit card and are available to individuals with good to excellent credit score. Unsecured credit cards do not require a security deposit and often offer higher credit limits and more attractive interest rates.

2. Secured Credit Cards: Designed for individuals with limited or poor credit history, secured credit cards require a refundable security deposit that serves as collateral. The credit limit is typically equal to or slightly higher than the deposit amount, making these cards ideal for building or rebuilding credit.

2. Rewards Credit Cards

Rewards credit cards are one of the 7 different types of credit cards and are designed to incentivize spending by offering various types of rewards programs. These cards can be highly beneficial for individuals who pay their balances in full each month and are looking to maximize their spending power. Some popular types of rewards credit cards, which are part of the 7 different types of credit cards, include:

1. Cash Back Credit Cards: These cards offer a percentage of cash back on eligible purchases, typically ranging from 1% to 5% depending on the card and spending categories.

2. Travel Rewards Credit Cards: Ideal for frequent travelers, these cards allow you to earn airline miles, hotel points, or travel credits that can be redeemed for flights, hotel stays, and other travel-related expenses.

3. Retail/Co-Branded Credit Cards: These cards are co-branded with specific retailers or brands and offer rewards specifically tailored to that brand, such as discounts, bonus points, or special offers.

3. Low-Interest Credit Cards

Low-interest credit cards are one of the 7 different types of credit cards and are designed for individuals who carry a balance from month to month or plan to make large purchases that can’t be paid off immediately. These cards, which are part of the 7 different types of credit cards, typically offer a lower annual percentage rate (APR) compared to standard credit cards, helping to reduce the amount of interest paid on outstanding balances.

Low-interest credit cards are one of the 7 different types of credit cards and are designed for individuals who carry a balance from month to month or plan to make large purchases that can’t be paid off immediately. These cards, which are part of the 7 different types of credit cards, typically offer a lower annual percentage rate (APR) compared to standard credit cards, helping to reduce the amount of interest paid on outstanding balances. It’s important to note that while low-interest credit cards can be beneficial for those carrying balances, it’s generally recommended to pay off balances in full each month to avoid accruing interest charges when using any of the 7 different types of credit cards.

4. Balance Transfer Credit Cards

Balance transfer credit cards are one of the 7 different types of credit cards and are specifically designed to help individuals consolidate and pay off existing credit card debt. These cards, which are part of the 7 different types of credit cards, often offer an introductory 0% APR promotional period, typically lasting 12 to 18 months, during which no interest is charged on transferred balances.

Balance transfer credit cards are one of the 7 different types of credit cards and are specifically designed to help individuals consolidate and pay off existing credit card debt. These cards, which are part of the 7 different types of credit cards, often offer an introductory 0% APR promotional period, typically lasting 12 to 18 months, during which no interest is charged on transferred balances. By transferring high-interest balances to a balance transfer credit card, which is one of the 7 different types of credit cards, individuals can potentially save a significant amount of money on interest payments while working to pay off their debt more efficiently.

5. Student Credit Cards

Student credit cards are one of the 7 different types of credit cards and are tailored specifically for college students who are just starting to build their credit history. These cards, which are part of the 7 different types of credit cards, often have lower credit limits and may require a co-signer or proof of income. While student credit cards typically offer fewer rewards and benefits compared to standard cards, they provide an excellent opportunity for students to establish responsible credit habits and build a solid credit foundation when using one of the 7 different types of credit cards.

6. Business Credit Cards

Business credit cards are one of the 7 different types of credit cards and are designed for small business owners and entrepreneurs to separate their personal and business expenses. These cards, which are part of the 7 different types of credit cards, often offer additional features and benefits tailored to business needs, such as higher credit limits, reward programs for business-related purchases, and expense tracking tools when using one of the 7 different types of credit cards.

Business credit cards are one of the 7 different types of credit cards and are designed for small business owners and entrepreneurs to separate their personal and business expenses. These cards, which are part of the 7 different types of credit cards, often offer additional features and benefits tailored to business needs, such as higher credit limits, reward programs for business-related purchases, and expense tracking tools when using one of the 7 different types of credit cards. Business credit cards can also help establish and build a business credit history, which can be beneficial when applying for business loans or securing favorable terms with vendors and suppliers while utilizing one of the 7 different types of credit cards.

7. Charge Cards

While often confused with credit cards, charge cards operate differently. With a charge card, the entire balance must be paid in full each month, and there is no option to carry a balance or accrue interest. Charge cards are typically geared towards individuals with excellent credit and high incomes, offering premium benefits and rewards.

Examples of popular charge cards include the American Express Platinum Card and the American Express Green Card, which provide access to exclusive travel perks, concierge services, and other luxury benefits.

Conclusion

Choosing the right credit card is a personal decision that depends on your financial situation, spending habits, and specific needs. Whether you’re looking for a standard credit card to build credit history, a rewards card to maximize your spending power, or a low-interest card to manage existing debt, understanding the different types of credit cards available can help you make an informed choice.

Remember, responsible credit card usage is key to maintaining a healthy credit score and achieving financial stability. By carefully evaluating your options, reviewing fees and interest rates, and using credit cards responsibly, you can leverage the power of plastic to your advantage and unlock a world of financial opportunities.