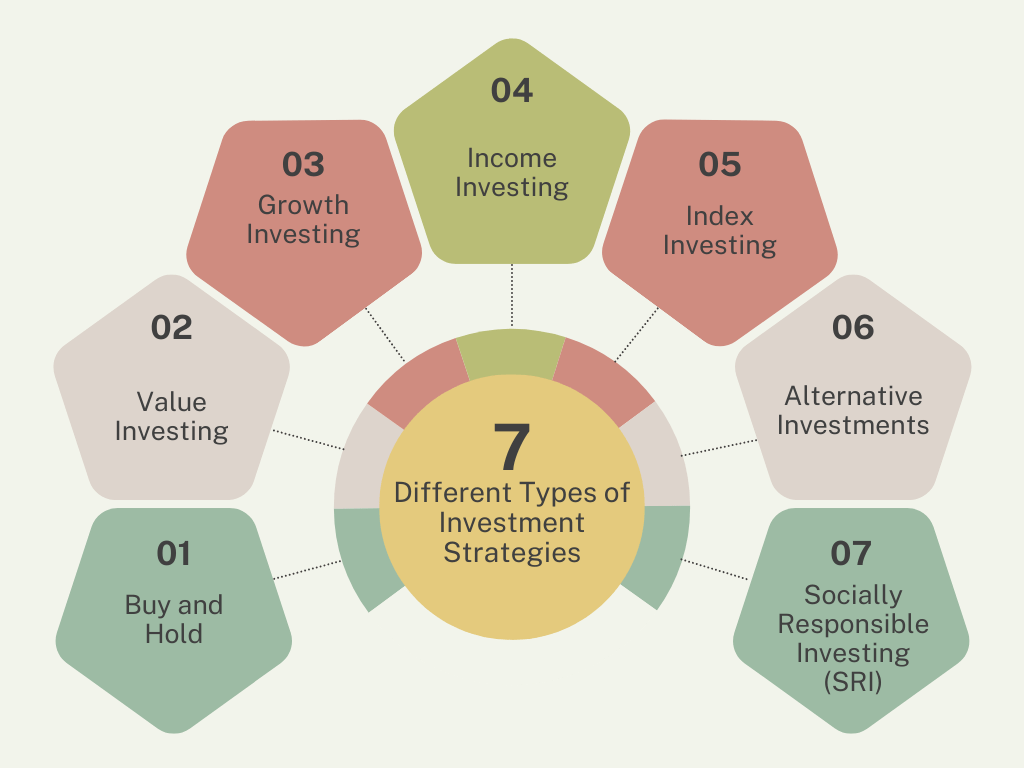

Exploring 7 Different Investment Strategies to Grow Your Wealth

Investing your money is one of the smartest ways to build long-term wealth and secure your financial future. However, with so many investment options available, it can be overwhelming to decide which strategy is right for you. In this comprehensive guide, we’ll explore seven Different Types of Investment Strategies, each with its own set of risks, rewards, and considerations.

1. Buy and Hold:

The buy and hold strategy is one of the simplest and most traditional approaches to investing, and one of the Different Types of Investment Strategies. It involves purchasing a diverse portfolio of stocks, bonds, or other assets and holding them for an extended period, typically several years or even decades. The underlying philosophy behind this strategy is that the stock market tends to rise over the long term, despite short-term fluctuations.

Pros:

– Simplicity: Buy and hold requires minimal effort and time commitment.

– Potential for long-term growth: Historical data shows that patient investors who stay invested through market cycles tend to achieve higher returns over the long run.

– Reduced trading costs: By minimizing buying and selling, investors avoid incurring excessive transaction fees and taxes.

Cons:

– Short-term volatility: During market downturns, investors may experience significant losses in the short term, which can be emotionally challenging.

– Lack of active management: This passive approach doesn’t allow investors to capitalize on market opportunities or adjust their portfolios based on changing conditions.

2. Value Investing:

Value investing is another of the Different Types of Investment Strategies. It focuses on identifying and purchasing undervalued stocks with strong fundamentals, such as solid financials, competitive advantages, and experienced management teams. The goal is to buy these stocks at a discount to their intrinsic value and hold them until the market recognizes their true worth.

Pros:

– Potential for higher returns: By purchasing undervalued stocks, value investors aim to benefit from the eventual price correction when the market recognizes the company’s true value.

– Risk mitigation: Value investing typically involves investing in established companies with proven track records, which can provide a margin of safety.

– Discipline: This strategy requires patience and a long-term perspective, which can help investors avoid impulsive decisions based on market noise.

Cons:

– Requires extensive research: Identifying truly undervalued stocks requires thorough analysis of financial statements, industry trends, and company management.

– Timing risk: Even if a stock is undervalued, there is no guarantee that the market will recognize its true value within a specific timeframe.

3. Growth Investing:

Growth investing is another of the Different Types of Investment Strategies. It focuses on investing in companies with strong growth potential. These companies often have innovative products or services, operate in rapidly expanding markets, and demonstrate a consistent track record of revenue and earnings growth.

Pros:

– Potential for high returns: If a company’s growth projections are met or exceeded, its stock price can skyrocket, leading to significant gains for investors.

– Exposure to emerging trends: Growth investors can benefit from investing in companies at the forefront of new technologies, products, or services.

– Diversification: Growth stocks can provide diversification benefits to a portfolio dominated by value or income-generating stocks.

Cons:

– High valuations: Growth stocks often trade at premium valuations, which can increase the risk of losses if growth expectations are not met.

– Volatility: Growth stocks tend to be more volatile, as their valuations are heavily dependent on future growth projections, which can change rapidly.

– Timing risk: Identifying the optimal entry and exit points for growth stocks can be challenging, as their growth trajectories can be unpredictable.

4. Income Investing:

Income investing is another of the Different Types of Investment Strategies. It focuses on generating a steady stream of passive income from investments such as dividend-paying stocks, bonds, real estate investment trusts (REITs), or other income-producing assets.

Pros:

– Steady income stream: Income-generating investments can provide a reliable source of cash flow, which can be particularly attractive for retirees or those seeking passive income.

– Potential for capital appreciation: In addition to income, some income-generating investments may also offer the potential for capital appreciation over time.

– Diversification: Income investments can help diversify a portfolio and provide a hedge against market volatility.

Cons:

– Lower growth potential: Income-generating investments may not offer the same growth potential as growth or value stocks, limiting the upside potential.

– Interest rate risk: For fixed-income investments like bonds, rising interest rates can negatively impact their value and income potential.

– Dividend risk: Companies can cut or suspend dividend payments during economic downturns or periods of financial stress.

5. Index Investing:

Index investing is another of the Different Types of Investment Strategies. It is a passive investment strategy that involves investing in a portfolio that tracks a specific market index, such as the S&P 500 or the Nasdaq Composite. This approach is often achieved through the use of index funds or exchange-traded funds (ETFs).

Pros:

– Diversification: Index funds provide instant diversification across a broad range of stocks or other assets, reducing the risk of concentrated investments.

– Low costs: Index funds typically have lower management fees and expenses compared to actively managed funds, which can lead to higher long-term returns.

– Simplicity: Index investing requires minimal research and decision-making, making it an accessible strategy for novice investors.

Cons:

– Limited upside potential: Index funds aim to match the performance of the underlying index, which means they may not outperform the market during bull runs.

– Lack of active management: Index funds do not have the flexibility to adjust their holdings based on market conditions or take advantage of specific investment opportunities.

– Market risk: Index funds are exposed to the overall movements of the market, which means they can experience significant losses during market downturns.

6. Alternative Investments:

Alternative investments, one of the Different Types of Investment Strategies, refer to a diverse range of asset classes beyond traditional stocks and bonds, such as real estate, private equity, hedge funds, commodities, and cryptocurrencies.

Pros:

– Diversification: Alternative investments can provide diversification benefits and potentially reduce overall portfolio risk by offering low or negative correlations with traditional asset classes.

– Potential for higher returns: Some alternative investments, like private equity or venture capital, have the potential for higher returns than traditional investments.

– Hedge against inflation: Certain alternative investments, like real estate or commodities, can serve as a hedge against inflation.

Cons:

– Higher risks: Alternative investments often carry higher risks, including liquidity risk, lack of transparency, and complex investment structures.

– Limited accessibility: Many alternative investments have high minimum investment requirements, making them less accessible to individual investors.

– Complexity: Understanding and analyzing alternative investments can be challenging, requiring specialized knowledge and expertise.

7. Socially Responsible Investing (SRI):

Socially responsible investing, also known as sustainable, ethical, or impact investing, is one of the Different Types of Investment Strategies. It aims to generate financial returns while also considering environmental, social, and governance (ESG) factors.

Pros:

– Alignment with values: SRI allows investors to align their investments with their personal values and ethical beliefs, promoting positive social and environmental change.

– Long-term sustainability: Companies with strong ESG practices may be better positioned for long-term success and resilience in an increasingly sustainability-focused world.

– Diversification: SRI portfolios can provide diversification benefits by investing in a wide range of industries and sectors that prioritize sustainability.

Cons:

– Limited investment universe: SRI restricts the investment universe by excluding certain companies or industries based on ethical or environmental criteria, potentially reducing diversification.

– Performance concerns: Some investors may be concerned that SRI strategies could underperform traditional investment strategies due to the additional screening criteria.

– Subjective criteria: The definition of what constitutes socially responsible investing can vary among investors, making it challenging to apply universal standards.

Choosing the Right Investment Strategy:

No single investment strategy from the Different Types of Investment Strategies is universally superior; each approach has its own unique advantages and drawbacks. The most appropriate strategy for you will depend on your financial goals, risk tolerance, investment horizon, and personal preferences.

It’s important to remember that successful investing often involves diversification across multiple asset classes and Different Types of Investment Strategies. By spreading your investments across different strategies from the Different Types of Investment Strategies, you can potentially reduce overall risk and enhance your chances of achieving long-term financial growth.

Additionally, it’s crucial to regularly review and adjust your investment strategy from the Different Types of Investment Strategies as your circumstances and market conditions change. What works for you today may not be the best approach in the future, so it’s essential to stay informed and adapt your strategy accordingly when considering the Different Types of Investment Strategies.

Conclusion: Different Types of Investment Strategies

Navigating the world of Different Types of Investment Strategies can be a complex and daunting task, but understanding the various approaches is crucial for making informed decisions and achieving your financial goals. Whether you’re a risk-taker seeking high-growth opportunities or a conservative investor prioritizing stability and income, there is an investment strategy tailored to your unique needs and preferences from the Different Types of Investment Strategies.

As you embark on your investment journey, remember that diversification across multiple strategies and asset classes is key to mitigating risk and maximizing potential returns. By combining different approaches from the Different Types of Investment Strategies, you can strike a balance between growth, income, and preservation of capital, ensuring a well-rounded and resilient portfolio.

It’s also important to regularly review and adjust your investment strategy from the Different Types of Investment Strategies as your circumstances and market conditions evolve. What may have been an appropriate approach in the past may no longer align with your current goals or risk tolerance. Embracing flexibility and adapting to changing dynamics is essential for long-term success when considering the Different Types of Investment Strategies.

Ultimately, successful investing is not just about choosing the right strategy from the Different Types of Investment Strategies; it’s also about developing discipline, patience, and a deep understanding of your own risk profile and investment objectives. By educating yourself, seeking professional guidance when needed, and remaining committed to your chosen strategies, you can navigate the complexities of the investment landscape and increase your chances of building lasting wealth.

Remember, investing is a journey, and the path to financial freedom is paved with informed decisions, unwavering commitment, and a willingness to adapt and evolve. Embrace the diverse range of Different Types of Investment Strategies available, and craft a portfolio that aligns with your unique goals and aspirations. With the right approach and mindset, you can unlock the potential for long-term growth and financial security.