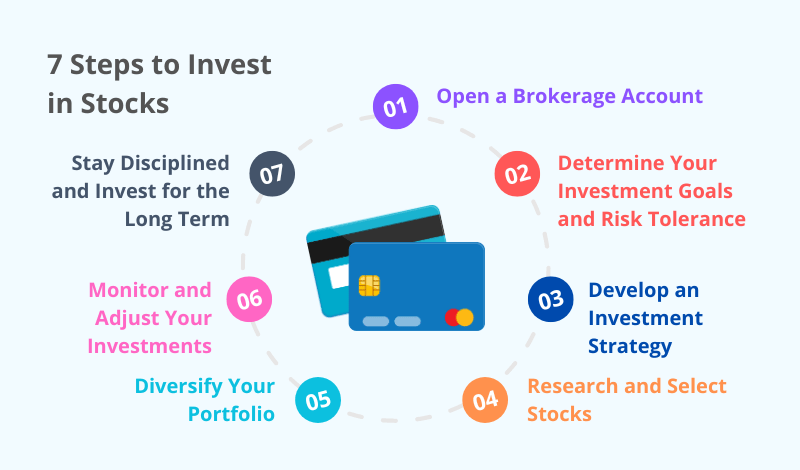

7 Steps to Invest in Stocks: A Beginner’s Guide for 2024

Are you looking to start investing in the stock market but not sure where to begin? Investing in stocks can be an excellent way to build wealth over the long term, but it’s crucial to understand the basics before you dive in. In this comprehensive guide, we’ll walk you through the 7 Steps to Invest in Stocks as a beginner in 2024.

Understanding the Stock Market

Before we discuss the 7 Steps to Invest in Stocks, it’s essential to grasp the fundamentals of the stock market. A stock represents ownership in a publicly-traded company. When you purchase a company’s stock, you become a partial owner and have a claim on a portion of the company’s assets and profits.

The stock market is where these publicly-traded company stocks are bought and sold. The two primary stock exchanges in the United States are the New York Stock Exchange (NYSE) and the Nasdaq. Now, let’s dive into the 7 Steps to Invest in Stocks.

Step 1: Open a Brokerage Account

The first step in the 7 Steps to Invest in Stocks is to open a brokerage account. To invest in stocks, you’ll need to open a brokerage account with a reputable online broker. A brokerage account is essentially a bank account for your investments, allowing you to buy and sell stocks, bonds, mutual funds, and other securities.

Some popular online brokers for beginners include Fidelity, Charles Schwab, E*TRADE, and TD Ameritrade. Many of these brokers offer commission-free trading on stocks and exchange-traded funds (ETFs), making it more affordable for beginners to start investing as part of the 7 Steps to Invest in Stocks.

Step 2: Determine Your Investment Goals and Risk Tolerance

The second step in the 7 Steps to Invest in Stocks is to define your investment goals and assess your risk tolerance. Before you start investing, it’s crucial to define your investment goals and assess your risk tolerance. Are you investing for retirement, a down payment on a house, or something else? Your investment goals will help determine your investment strategy and the types of stocks you should consider.

Risk tolerance refers to your ability to withstand market fluctuations and potential losses. Generally, the higher the potential return, the higher the risk. As a beginner, it’s essential to understand that investing in stocks carries inherent risks, and you should only invest money you can afford to lose as part of the 7 Steps to Invest in Stocks.

Step 3: Develop an Investment Strategy

The third step in the 7 Steps to Invest in Stocks is to develop an investment strategy. Once you’ve established your investment goals and risk tolerance, it’s time to develop an investment strategy. There are various approaches to investing in stocks, including:

1. Value Investing: This strategy involves buying stocks that are undervalued by the market, based on fundamentals such as earnings, assets, and growth potential.

2. Growth Investing: This approach focuses on investing in companies with strong growth prospects, often in emerging or rapidly expanding industries.

3. Dividend Investing: Investors who follow this strategy prioritize companies that pay consistent and growing dividends, providing a steady stream of income.

4. Index Investing: This strategy involves investing in index funds or exchange-traded funds (ETFs) that track a broader market index, such as the S&P 500 or Nasdaq Composite.

Your investment strategy should align with your goals, risk tolerance, and investment horizon (how long you plan to hold the investment) as part of the 7 Steps to Invest in Stocks.

Step 4: Research and Select Stocks

The fourth step in the 7 Steps to Invest in Stocks is to research and select stocks. Once you’ve determined your investment strategy, it’s time to research and select stocks that fit your criteria. Here are some factors to consider when evaluating potential investments:

1. Company Financials: Analyze the company’s financial statements, including revenue, earnings, cash flow, and debt levels, to assess its financial health and growth potential.

2. Competitive Advantage: Look for companies with a sustainable competitive advantage, such as a strong brand, proprietary technology, or a dominant market position.

3. Management and Corporate Governance: Evaluate the company’s management team and corporate governance practices to ensure they align with your values and investment goals.

4. Industry Trends and Outlook: Consider the industry’s growth prospects, emerging trends, and potential disruptions that could impact the company’s performance.

You can find valuable information on companies and industries from sources like annual reports, financial news websites, and research reports from reputable investment firms as part of the 7 Steps to Invest in Stocks.

Step 5: Diversify Your Portfolio

The fifth step in the 7 Steps to Invest in Stocks is diversification. Diversification is a fundamental principle of investing that helps mitigate risk. By spreading your investments across different sectors, industries, and asset classes, you can reduce the impact of any single investment’s performance on your overall portfolio.

As a beginner, you may want to consider investing in low-cost, diversified index funds or ETFs that track broad market indices as part of the 7 Steps to Invest in Stocks. These funds provide instant diversification and can be an excellent way to build a solid foundation for your investment portfolio.

Step 6: Monitor and Adjust Your Investments

The sixth step in the 7 Steps to Invest in Stocks is to monitor your investments regularly. Investing in stocks is an ongoing process, and it’s crucial to monitor your investments regularly. Keep track of your portfolio’s performance, review company news and updates, and adjust your holdings as needed.

Consider rebalancing your portfolio periodically to maintain your desired asset allocation and risk level. This may involve selling some investments that have outperformed and reinvesting the proceeds into underperforming areas.

Step 7: Stay Disciplined and Invest for the Long Term

Successful investing requires discipline and a long-term mindset. Avoid making impulsive decisions based on short-term market fluctuations or emotional responses. Instead, stick to your investment strategy and focus on your long-term goals.

Remember, the stock market can be volatile, and short-term losses are a normal part of the investing process. By staying disciplined and investing for the long term, you can potentially ride out market cycles and benefit from the power of compound growth.

Conclusion: 7 Steps to Invest in Stocks

Investing in stocks can be an excellent way to build wealth over time, but it’s essential to approach it with a solid understanding of the risks and a well-defined strategy. By following the steps outlined in this guide, you’ll be well on your way to becoming a successful stock investor in 2024 and beyond.

Remember, investing is a journey, and continuous learning and adaptation are key to long-term success. Stay informed, diversify your portfolio, and remain disciplined in your approach. With patience and perseverance, you can potentially achieve your financial goals through stock investing.