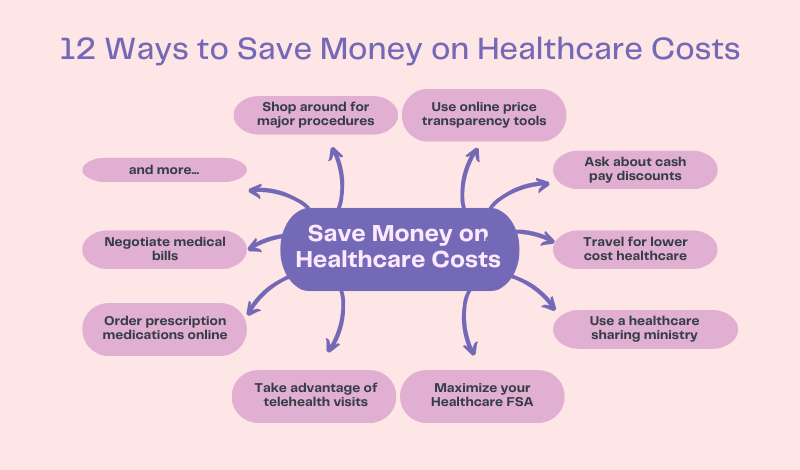

12 Smart Strategies to Cut Your Healthcare Costs

Save Money on Healthcare Costs: With healthcare costs rising year after year, finding ways to save on medical expenses is more important than ever. Even if you have health insurance, out-of-pocket costs like deductibles, copays, and coinsurance can add up fast. Don’t overpay for care – use these 12 money-saving tips to cut your healthcare costs significantly.

1. Shop around for major procedures:

Save Money on Healthcare Costs: For non-emergency medical services, take the time to call multiple providers and compare prices. The cost of surgeries, MRI scans, lab tests and other billable procedures can vary wildly between hospitals and clinics. Asking for price quotes upfront allows you to find the most affordable care.

2. Use online price transparency tools:

Save Money on Healthcare Costs: To assist medical consumers in comparing prices, many states now require hospitals and insurers to make their pricing data available online. Use these price transparency tools to research the fair market rates for services in your area before committing to a provider.

3. Ask about cash pay discounts:

Save Money on Healthcare Costs: Surprisingly, some healthcare providers offer lower cash rates for patients paying out-of-pocket rather than going through an insurance company. Always ask if there is a “self-pay discount” available to save money by covering the full bill yourself.

4. Travel for lower cost healthcare:

Save Money on Healthcare Costs: Did you know you can travel abroad to receive affordable, quality healthcare for major procedures? Countries like Mexico, Costa Rica, and Thailand offer huge medical cost savings for those willing to get treatment outside the U.S.

5. Use a healthcare sharing ministry:

Save Money on Healthcare Costs: As an alternative to traditional health insurance, joining a healthcare sharing ministry can lower your monthly costs substantially. Members directly share one another’s major medical bills at a fraction of the cost of insurance premiums.

6. Maximize your Healthcare FSA:

Save Money on Healthcare Costs: If you have access to a Healthcare Flexible Spending Account (FSA) through your employer, max out your annual contributions. An FSA allows you to pay for out-of-pocket healthcare costs using pre-tax dollars, saving you roughly 30% on qualified expenses.

7. Take advantage of telehealth visits:

Save Money on Healthcare Costs: A growing number of health insurers are offering low or no co-pay visits with telehealth providers. Rather than scheduling an expensive in-person appointment, connect virtually to receive care and treatment for minor conditions.

8. Order prescription medications online:

Save Money on Healthcare Costs: Websites like GoodRx, WebMDRx, and others allow you to purchase prescription medications online at far lower rates than traditional pharmacies. Just submit your prescription details and payment online, then have your order conveniently delivered.

9. Negotiate medical bills:

Save Money on Healthcare Costs: Did you receive an exorbitant bill for healthcare services? Don’t be afraid to call the provider’s billing office and ask if they can lower the costs. Explain your financial situation – you may be able to settle for a lower lump sum.

10. Join a prescription assistance program:

Save Money on Healthcare Costs: If paying for medications places a high financial burden, look into applying for a Prescription Assistance Program (PAP). These programs are sponsored by drug manufacturers to provide steep discounts or free medications to low-income households.

11. Stick with in-network providers:

Save Money on Healthcare Costs: One of the easiest ways for health insurance members to reduce costs is simply sticking to doctors and facilities within their insurance network. Out-of-network care can result in shockingly high bills if your insurer elects not to cover those claims.

12. Consider a high deductible health plan:

Save Money on Healthcare Costs: Though high deductible health plans (HDHPs) require higher out-of-pocket spending before coverage kicks in, the monthly premium for an HDHP is generally far lower. These plans make sense for young, healthy individuals willing to bet against high care costs.

Save Money on Healthcare Costs: By employing smart healthcare shopping habits and taking advantage of cost-saving alternatives, you can drastically reduce your annual medical spending. Don’t overpay – use these 12 tips to cut your healthcare costs today.

Conclusion: Save Money on Healthcare Costs

Save Money on Healthcare Costs: Taking control of your healthcare costs is essential in today’s environment of rising medical expenses. By implementing the strategies outlined above, you can potentially save thousands of dollars each year without sacrificing the quality of care you receive.

From shopping around for major procedures and negotiating medical bills to exploring alternatives like healthcare sharing ministries and prescription assistance programs, there are numerous opportunities to reduce your out-of-pocket spending. Even simple steps like maximizing your FSA contributions and utilizing telehealth services can lead to significant savings over time.

Ultimately, being an informed and proactive healthcare consumer is key to keeping your costs manageable. Don’t simply accept inflated medical bills at face value – arm yourself with the knowledge and tools necessary to make cost-effective decisions about your care. Taking charge of your healthcare costs today can lead to a healthier financial future for you and your family.