Unsure of the most effective way to create a budget? Learn how to craft a plan that fits your lifestyle and financial goals. This guide explores methods, tools, and tips to empower you to take control of your money

2 Most Effective Way to Create a Budget

Having a budget is one of the most important things you can do to get control of your finances and achieve your money goals. There are many methods out there, but this guide will explore an effective way to create a budget that fits your lifestyle and financial goals. However, many people struggle with actually creating and sticking to a budget. The process can seem intimidating and restrictive. The key is finding a budgeting method that works for your lifestyle and situation. Here’s a look at one of the most effective ways to create a budget that you can actually follow.

Track Your Spending First:

The first step in creating an effective budget(“Effective way to create a budget”) is understanding where your money is currently going. This allows you to create a realistic budget based on your actual spending patterns and habits. For at least a month, track every dollar you spend using a budgeting app, notebook, or spreadsheet. Don’t try to change your behavior just yet – just record everything from your mortgage/rent and utility bills down to that daily coffee and any cash purchases or withdrawals. Categorize your expenses into groups like housing, transportation, food, entertainment, etc.

Once you have a clear picture of your monthly spending, calculate your total monthly income from all sources. This will allow you to see if you have a surplus or deficit each month. It will also show you how much you are spending in different categories so you can identify areas to cut back.

The 50/30/20 Budgeting Method

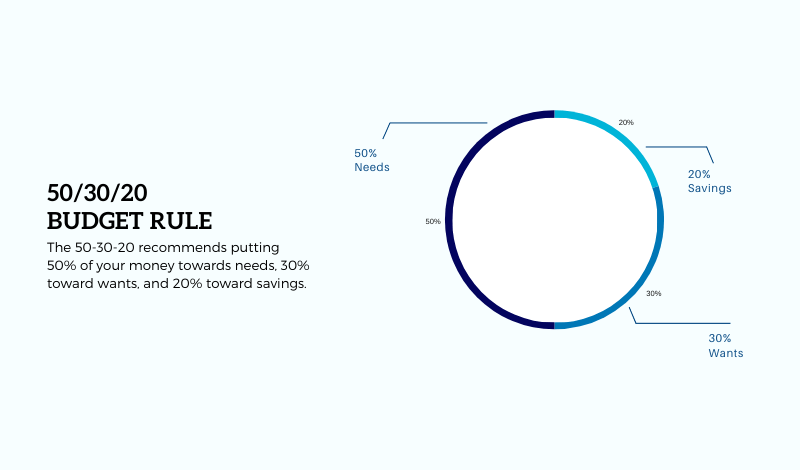

Now it’s time to actually set up a monthly budget. One effective approach is the 50/30/20 budget method. With this model:

- 50% of your income goes towards essential expenses like housing, utilities, groceries, transport, minimum debt payments. These are your needs.

- 30% goes towards discretionary spending like dining out, entertainment, new clothes, and other wants.

- 20% goes towards savings/investments and extra debt payments beyond minimums.

For example, if your monthly take-home income is $4,000:

- $2,000 would go towards needs

- $1,200 for wants

- $800 for savings/debt repayment

The percentages don’t have to be exact to the decimal point each month. This budget simply aims to create a balanced lifestyle while allowing you to save and pay down debts.

Track Spending Daily

Effective way to create a budget: The key to making this or any budget actually work is tracking your spending daily and sticking to your allocated amounts. If you let spending get away from you in any category, make adjustments in another non-essential area to compensate. Be realistic – if you find yourself constantly going over in restaurants, you may need to increase that budget amount and reduce something else.

Make a Budget That Works for You:

For a budget to be effective long-term, it needs to be tailored to your income, expenses, and lifestyle. The 50/30/20 ratio is just a guideline. If you have a lot of debt (4 best strategy for paying off debt) , you may need to allocate much more than 20% towards repayment initially. Or if you have very high rent or mortgage costs, you may need to allocate more than 50% towards needs while limiting wants spending.

The budget categories can also be customized. For example, you may want to separate entertainment, dining out, and personal spending like clothes or hobbies into different categories to make cutting back easier if needed.

The most important thing is to make your budget realistic and sustainable based on your current finances. It doesn’t mean you can never dine out or have fun – you’re just being more conscious about when and how much you spend on different things.

Budgeting is a habit that gets easier over time. But getting started and finding an effective method that clicks for you is key. By tracking your real spending first, using a balanced method like 50/30/20, and customizing as needed, you’ll be on your way to taking control of your finances.

Conclusion: 2 most effective way to create a budget

In conclusion, an effective way to create a budget starts with understanding your current spending habits by tracking every expense for at least a month. This data allows you to build a realistic budget based on your actual lifestyle costs. The 50/30/20 budgeting method provides a balanced framework allocating 50% for needs, 30% for wants, and 20% for savings and debt repayment. However, the percentages can be adjusted to your specific situation.

The most important aspects of an effective way to create a budget are making it sustainable long-term by aligning it with your income and existing expenses. Customize categories as needed and be prepared to make adjustments if you consistently overspend in certain areas. Diligently track daily spending against your new budget. With patience and the right approach tailored to your goals, a budget can empower you to gain control of your finances.