A Comprehensive Guide to Investing in Peer-to-Peer Lending

Peer-to-peer (P2P) lending has emerged as a popular alternative investment option in recent years, allowing individuals to lend money directly to borrowers, bypassing traditional financial institutions. This innovative approach has opened up new opportunities for investors seeking higher returns while providing access to credit for borrowers who may not qualify for traditional loans. Invest in Peer-To-Peer Lending and delve into the world of P2P lending, exploring its workings, potential benefits, risks, and steps to get started as an investor in this comprehensive guide.

Understanding Peer-to-Peer Lending

Peer-to-peer lending is a form of crowdsourced lending facilitated by online platforms that connect borrowers with individual investors willing to fund their loan requests. These platforms act as intermediaries, facilitating the loan process, conducting credit checks, and ensuring that loan payments are distributed to investors. Invest in Peer-To-Peer Lending through these online platforms that connect borrowers and lenders directly.

Instead of borrowing from banks or credit unions, individuals or businesses seeking loans can access funds from a pool of investors through these P2P lending platforms. Invest in Peer-To-Peer Lending, and you can become part of the pool of investors providing funds to borrowers. The process is typically faster and more convenient than traditional lending channels, as the underwriting process is streamlined, and loan approvals can be obtained more quickly.

Benefits of Investing in Peer-to-Peer Lending

1. Potential for Higher Returns: One of the primary attractions of P2P lending for investors is the potential to earn higher returns compared to traditional fixed-income investments like bonds or savings accounts. By lending directly to borrowers, investors can potentially capture a larger share of the interest payments, resulting in higher yields.

2. Portfolio Diversification: P2P lending offers an opportunity to diversify an investment portfolio beyond traditional asset classes. By investing in consumer or business loans, investors can gain exposure to a different asset class that may not be directly correlated with the performance of stocks or bonds, potentially reducing overall portfolio risk.

3. Access to a Growing Market: The P2P lending market has experienced significant growth in recent years, with platforms facilitating billions of dollars in loans annually. As the industry continues to expand, it presents investors with access to a growing pool of investment opportunities.

4. Flexibility and Control: P2P lending platforms often provide investors with the ability to choose the loans they want to fund based on factors such as credit scores, interest rates, and loan purposes. This level of control allows investors to tailor their investments according to their risk tolerance and investment objectives.

Risks and Considerations

Invest in Peer-To-Peer Lending, While P2P lending offers potential benefits, it is essential to understand the associated risks and considerations:

1. Credit Risk: As with any lending activity, there is a risk that borrowers may default on their loan payments. P2P lending platforms typically conduct credit checks and assign risk ratings to borrowers, but investors should carefully evaluate the creditworthiness of borrowers before investing.

2. Platform Risk: Investors are reliant on the P2P lending platform to facilitate the loan process, manage payments, and handle collections in case of defaults. The performance and reliability of the platform itself can impact the overall investment experience.

3. Liquidity Risk: P2P loans are typically illiquid investments, meaning that investors cannot easily sell their loan positions on a secondary market. Investors should be prepared to hold their investments until maturity.

4. Regulatory Risk: The P2P lending industry is subject to evolving regulations, which can impact the operations and practices of lending platforms. Investors should stay informed about regulatory changes that may affect their investments.

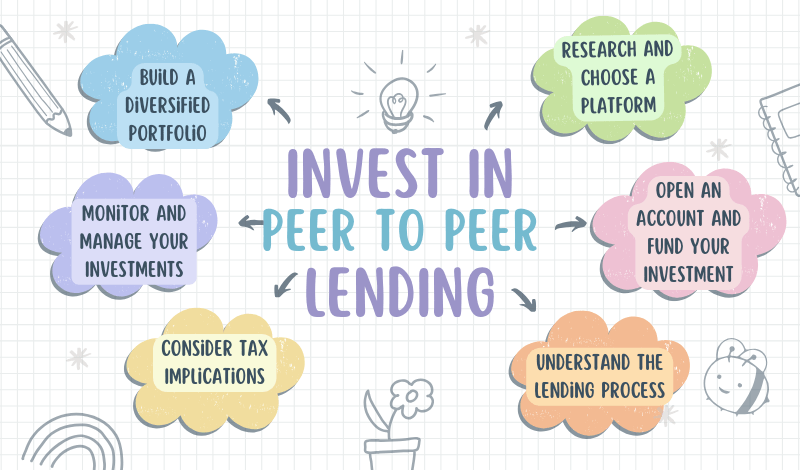

Steps to Get Started with Peer-to-Peer Lending

Invest in Peer-To-Peer Lending, If you’re interested in investing in P2P lending, here are the steps you can follow:

1. Research and Choose a Platform:

Begin by researching reputable P2P lending platforms operating in your region. Compare factors such as fees, loan types, borrower vetting processes, historical returns, and investor protections. Popular platforms include LendingClub, Prosper, Funding Circle, and UpStart, among others.

2. Open an Account and Fund Your Investment:

Once you’ve selected a platform, create an investor account by providing the necessary personal and financial information. You’ll typically need to link a funding source, such as a bank account or a transfer from another investment account, to deposit funds into your P2P lending account.

3. Understand the Lending Process:

Familiarize yourself with the lending process on the chosen platform. This includes understanding how borrowers are vetted, how loan listings are presented, and the criteria for choosing which loans to fund. Many platforms provide tools and filters to help investors identify loans that align with their investment goals and risk tolerance.

4. Build a Diversified Portfolio:

Diversification is crucial in P2P lending to mitigate the impact of potential defaults. Consider spreading your investments across multiple loans with varying credit profiles, loan amounts, and loan purposes. Most platforms allow you to invest in fractions of loans, enabling easier diversification.

5. Monitor and Manage Your Investments:

Once you’ve funded loans, regularly monitor the performance of your investments through the platform’s dashboard or reporting tools. Keep track of payments received, late payments, and any potential defaults. Some platforms offer automated reinvestment options, allowing you to reinvest payments received into new loans.

6. Consider Tax Implications:

Consult with a tax professional or review the tax guidelines provided by the P2P lending platform to understand the tax implications of your investments. Interest income earned from P2P loans is typically taxable, and proper record-keeping is essential for reporting purposes.

As with any investment, it’s crucial to conduct thorough research, understand the risks involved, and invest within your risk tolerance when you Invest in Peer-To-Peer Lending. Starting with a small investment and gradually building your portfolio as you gain experience can be a prudent approach.

Building a Successful P2P Lending Strategy

If you Invest in Peer-To-Peer Lending, to maximize the potential benefits and mitigate risks, consider implementing the following strategies:

1. Diversify Across Platforms:

While diversifying within a single platform is essential, consider spreading your investments across multiple P2P lending platforms. Each platform may have different borrower pools, underwriting criteria, and loan types, providing additional diversification opportunities.

2. Utilize Automated Investment Tools:

Many P2P lending platforms offer automated investment tools that can help streamline the process of building a diversified portfolio. These tools allow you to set criteria based on your investment goals and risk tolerance, and the platform automatically selects and invests in loans that meet your specifications.

3. Consider Investing in Loan Portfolios or Funds:

Some platforms offer the option to invest in pre-packaged loan portfolios or funds, which can provide instant diversification across multiple loans. These products may be suitable for investors seeking a more hands-off approach or those with limited time to manually select individual loans.

4. Regularly Review and Rebalance:

Periodically review the performance of your P2P lending portfolio and rebalance as needed. This may involve reinvesting payments received into new loans, adjusting your investment criteria based on changing market conditions, or exiting underperforming loans if possible.

5. Integrate with Your Overall Investment Strategy:

While P2P lending can offer attractive returns, it’s essential to consider how it fits into your overall investment strategy and risk tolerance. Determine an appropriate allocation to P2P lending based on your investment goals, time horizon, and risk profile.

The Future of Peer-to-Peer Lending

If you plan to Invest in Peer-To-Peer Lending, be aware that the P2P lending industry continues to evolve, with new players entering the market and existing platforms expanding their offerings. Here are some potential developments to watch out for:

1. Increased Institutional Involvement:

While P2P lending initially catered primarily to individual investors, there has been growing interest from institutional investors seeking alternative investment opportunities. This influx of institutional capital could drive further growth and innovation in the industry.

2. Integration of Technology and Alternative Data:

P2P lending platforms are leveraging advanced technologies, such as machine learning and alternative data sources, to enhance credit risk assessment and improve underwriting processes. This could lead to more accurate risk evaluation and potentially higher returns for investors.

3. Expansion into New Asset Classes:

While consumer and small business loans have been the primary focus of P2P lending, some platforms are exploring new asset classes like real estate, invoice financing, and renewable energy projects. This diversification could provide investors with additional investment options within the P2P lending space.

4. Regulatory Developments:

As the P2P lending industry matures, regulatory bodies may introduce new guidelines or oversight mechanisms to ensure consumer protection and mitigate potential risks. Staying informed about regulatory changes will be crucial for investors navigating this evolving landscape.

Peer-to-peer lending has opened up a new frontier in alternative investments, offering individual investors the opportunity to earn attractive returns while providing access to credit for borrowers. Invest in Peer-To-Peer Lending and by understanding the fundamentals, assessing the risks, and implementing sound investment strategies, investors can potentially benefit from this growing industry. However, as with any investment, it’s essential to conduct thorough research, diversify your portfolio, and invest within your risk tolerance.

Conclusion: Invest in Peer-To-Peer Lending

Invest in Peer-To-Peer Lending and you’ll be part of a movement that has disrupted the traditional lending landscape, providing a unique investment opportunity for individuals seeking higher returns and portfolio diversification. By connecting borrowers directly with lenders through online platforms, P2P lending offers a streamlined and potentially lucrative alternative to traditional investment channels.

Invest in Peer-To-Peer Lending, However, as with any investment, it’s crucial to approach Invest in Peer-To-Peer Lending with a well-informed and disciplined mindset. Conducting thorough research, understanding the risks involved, and implementing sound investment strategies are essential for maximizing the potential benefits while mitigating the associated risks.

Invest in Peer-To-Peer Lending, As you Invest in Peer-To-Peer Lending, investors should stay abreast of new developments, regulatory changes, and emerging trends. The integration of advanced technologies, the entry of institutional investors, and the expansion into new asset classes could shape the future of this dynamic industry.

Invest in Peer-To-Peer Lending, Ultimately, Invest in Peer-To-Peer Lending and you’ll be presented with an exciting investment opportunity for those willing to navigate its complexities and embrace its potential rewards. By diversifying across platforms, leveraging automated investment tools, and aligning P2P lending investments with overall financial goals, investors can potentially unlock a new source of income and diversification within their portfolios.

Invest in Peer-To-Peer Lending, While no investment is without risk, those who approach Invest in Peer-To-Peer Lending with prudence, discipline, and a long-term perspective may find it to be a rewarding addition to their investment strategies. As with any financial decision, it’s essential to consult with qualified professionals and carefully consider your individual circumstances before diving into the world of peer-to-peer lending.