A Comprehensive Guide to Socially Responsible Investing

Investing has traditionally been viewed through the lens of maximizing financial returns. However, a growing number of investors are recognizing the importance of aligning their investments with their personal values and ethical principles. This shift has given rise to a concept known as socially responsible investing (SRI), which involves considering environmental, social, and governance (ESG) factors alongside financial performance when making investment decisions.

If you’re someone who wants to make a positive impact with your investment portfolio and Invest in Socially Responsible Investments, socially responsible investing might be the right approach for you. In this comprehensive guide, we’ll explore what SRI entails, why it matters, and how you can incorporate it into your investment strategy.

Understanding Socially Responsible Investing:

Socially responsible investing, also known as sustainable, ethical, or impact investing, is an investment approach that aims to generate both financial returns and positive social or environmental impact. It involves actively selecting or excluding investments based on specific criteria related to ESG factors. For those looking to Invest in Socially Responsible Investments, this approach provides a way to align their investment portfolio with their values and principles.

Environmental factors typically include a company’s environmental policies, greenhouse gas emissions, energy efficiency, waste management, and use of renewable resources. Social factors encompass workplace diversity, human rights, community relations, and labor practices. Governance factors focus on corporate governance practices, such as board composition, executive compensation, and shareholder rights. Investors looking to Invest in Socially Responsible Investments take these ESG factors into consideration when evaluating potential investments.

By considering these factors, socially responsible investors seek to support companies that demonstrate ethical and sustainable business practices while avoiding those that may have negative impacts on society or the environment. This approach allows investors who want to Invest in Socially Responsible Investments to align their portfolios with their values and principles.

Strategies for Socially Responsible Investing:

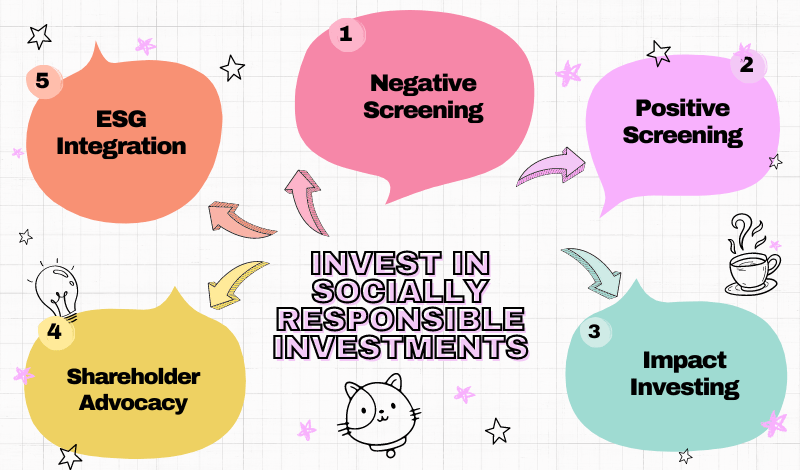

There are several approaches you can take when it comes to socially responsible investing and deciding how to Invest in Socially Responsible Investments. Here are some common strategies:

1. Negative Screening:

This approach involves excluding companies or industries that engage in activities deemed unethical or harmful. Common exclusions include tobacco, weapons, fossil fuels, and companies with poor labor practices or human rights records.

2. Positive Screening:

Instead of excluding companies, positive screening focuses on actively seeking out companies that demonstrate strong ESG performance. This may include companies with robust environmental policies, fair labor practices, or commitments to diversity and inclusion.

3. Impact Investing:

Impact investing takes socially responsible investing a step further by actively investing in companies, organizations, or funds that aim to generate measurable positive social or environmental impact alongside financial returns. Examples include investments in renewable energy, affordable housing, or microfinance initiatives.

4. Shareholder Advocacy:

Socially responsible investors can engage in shareholder advocacy by using their voting rights to influence corporate policies and practices. This may involve filing shareholder resolutions, voting on ESG-related proposals, or engaging with company management to promote sustainable and ethical practices.

5. ESG Integration:

This approach involves systematically incorporating ESG factors into traditional financial analysis and investment decision-making processes. Portfolio managers and analysts evaluate a company’s ESG performance alongside traditional financial metrics when assessing investment opportunities.

Investing in Socially Responsible Funds:

One of the easiest ways to Invest in Socially Responsible Investments and incorporate socially responsible investing into your portfolio is by investing in dedicated SRI funds. These funds are professionally managed and typically follow specific screening criteria or investment strategies aligned with ESG principles.

There are several types of socially responsible funds available:

1. Mutual Funds:

Socially responsible mutual funds are diversified investment vehicles that pool money from multiple investors and invest in a portfolio of companies that meet specific ESG criteria. These funds are managed by professional fund managers and can provide exposure to a range of asset classes, including stocks, bonds, and alternative investments.

2. Exchange-Traded Funds (ETFs):

Socially responsible ETFs are similar to mutual funds but trade like individual stocks on exchanges. They track specific ESG indices or follow predefined ESG investment strategies.

3. Separately Managed Accounts (SMAs):

With SMAs, a professional investment manager creates a customized portfolio tailored to an individual investor’s specific ESG preferences and risk profile.

When evaluating socially responsible funds, it’s essential to review their investment objectives, screening criteria, and performance history. Many fund providers offer detailed information about their ESG integration processes and the specific factors they consider.

Why Socially Responsible Investing Matters:

There are several compelling reasons why socially responsible investing has gained traction in recent years and why investors may choose to Invest in Socially Responsible Investments:

1. Aligning Investments with Values:

Many investors want their investments to reflect their personal values and beliefs. SRI allows them to invest in companies that align with their ethical principles, whether it’s environmental stewardship, social justice, or corporate governance.

2. Mitigating Risk:

Companies with strong ESG practices are often better positioned to manage risks associated with issues like climate change, regulatory changes, and reputational damage. By considering ESG factors, investors can potentially mitigate long-term risks and enhance the sustainability of their investments.

3. Driving Positive Change:

By investing in socially responsible companies, investors can influence corporate behavior and encourage more sustainable and ethical practices. As more capital flows into these companies, they are incentivized to improve their ESG performance, creating a virtuous cycle of positive change.

4. Potential for Long-term Performance:

While the primary motivation for SRI is often values-based, some studies suggest that companies with strong ESG practices may also deliver better long-term financial performance. This is attributed to factors such as better risk management, innovation, and customer loyalty.

Building a Socially Responsible Portfolio:

If you prefer to take a more hands-on approach to Invest in Socially Responsible Investments, you can build a socially responsible portfolio by selecting individual stocks, bonds, or other investments that align with your ESG priorities. This approach allows for greater customization but requires more research and analysis.

To Invest in Socially Responsible Investments and build a socially responsible portfolio, you can use a combination of the strategies mentioned earlier, such as negative screening, positive screening, and shareholder advocacy. Additionally, you can consult ESG research and ratings provided by specialized firms that evaluate companies based on their ESG performance.

It’s important to note that building a well-diversified portfolio is still crucial when you Invest in Socially Responsible Investments. Diversification across different asset classes, sectors, and geographic regions can help mitigate risk and improve the overall risk-adjusted returns of your portfolio.

Considerations and Challenges:

While Invest in Socially Responsible Investments offers many benefits, it’s essential to be aware of some considerations and challenges:

1. Varying Definitions and Standards:

There is no universally accepted definition or set of standards for what constitutes a “socially responsible” investment. Different investors, fund managers, and rating agencies may have varying interpretations and criteria.

2. Limited Investment Universe:

By excluding certain companies or industries based on ESG criteria, socially responsible investors may have a more limited investment universe to choose from, potentially affecting diversification and portfolio construction.

3. Data Availability and Quality:

Reliable and consistent ESG data can be challenging to obtain, as companies may report differently or provide incomplete information. This can make it difficult to accurately assess a company’s ESG performance.

4. Potential for Underperformance:

While some studies suggest that socially responsible investments can perform well in the long run, there is a possibility of underperformance in certain market conditions or compared to non-SRI investments.

5. Costs:

Some socially responsible funds may have higher expense ratios or management fees compared to traditional funds, potentially impacting overall returns.

Despite these challenges, socially responsible investing continues to gain momentum as more investors prioritize aligning their investments with their values and contributing to a more sustainable future.

Conclusion: Invest in Socially Responsible Investments

Invest in Socially Responsible Investments is an investment approach that considers environmental, social, and governance factors alongside financial performance. By investing in companies and funds that demonstrate strong ESG practices, investors can align their investments with their personal values while potentially mitigating risks and driving positive change.

Whether you choose to Invest in Socially Responsible Investments through socially responsible funds or build a customized portfolio, it’s essential to carefully research and understand the investment objectives, screening criteria, and performance history of the investments you select. Additionally, it’s crucial to maintain a well-diversified portfolio and be aware of the potential challenges and limitations of socially responsible investing.

As the demand for responsible and sustainable investments continues to grow, it’s likely that the availability of SRI options, data quality, and industry standards will continue to improve. By embracing socially responsible investing and choosing to Invest in Socially Responsible Investments, you can contribute to a more sustainable and equitable future while potentially achieving your financial goals.